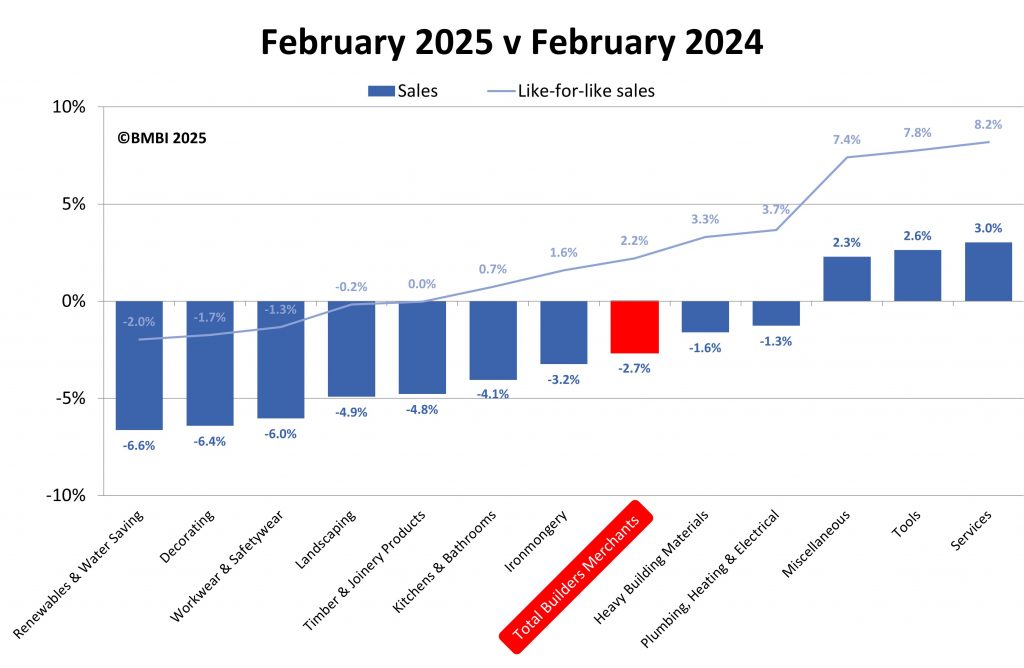

The latest Builders Merchant Building Index (BMBI) report shows builders’ merchants’ value sales in February were down -2.7% compared to the same month in 2024. Volume sales remain flat (-0.1%) while prices dropped -2.6%. With one less trading day in the most recent period, like-for-like value sales were up +2.2%.

Year-on-Year

Just three categories sold more year-on-year in value terms – Services (+3.0%), Tools (+2.6%) and Miscellaneous (+2.3%). Plumbing, Heating & Electrical (-1.3%) and Heavy Building Materials (-1.6%) while still down, performed better than Total Merchants. Decorating (-6.4%) and Renewables & Water Saving (-6.6%) were the weakest categories.

Month-on-Month

Value sales in February were +4.4% higher than January. Nine of the twelve categories sold more, including three which did better than Total Builders Merchants – these were Landscaping (+15.1%), Services (+6.1%) and Heavy Building Materials (+5.4%). Workwear & Safetywear was the weakest category, down -8.3%. With two less trading days in February, like-for-like value sales were up +14.8%. Total volume sales rose +8.0% and prices were down -3.4%.

Latest 12 months

Total value sales in the period March 2024 to February 2025 were down -4.0% on the previous 12-month period (March 2023 to February 2024). Four of the twelve categories sold more with Workwear & Safetywear (+6.8%) and Tools (+6.6%) ahead, followed by Services (+3.2%) and Miscellaneous (+0.2%). Timber & Joinery Products (-6.2%) and Heavy Building Materials (-4.8%) – the two largest categories – declined more than Total Merchants, while Renewables & Water Saving (-21.2%) was the weakest category. Total volume sales dropped -3.5% and prices slipped -0.4%.

Matt Williams, Managing Director for Polypipe Building Products and the BMBI Expert for Heating and Cooling, comments:

“Since the start of 2025, the Chancellor of the Exchequer has been making increasingly positive noises about growth, specifically around speeding up planning approvals for the development of new homes. The government is backing housing developments in key areas such as zones close to commuter transport hubs, with a view to providing housing that targets working families. These ideas were formally presented in the new Planning and Infrastructure Bill in March.

“Coming out of 2024, we can reflect on a difficult year which, on the surface, may not have delivered particularly positive market conditions. However, there were many progressive actions being taken in the housing industry regarding heating and cooling. Most, if not all, major housing developers are now actively planning for their heating systems of the future, and planning for The Future Homes Standard.

“2024 was the year when UK housebuilders started deep diving into what heating solutions they may couple with Air Source Heat Pumps in new build homes, with several housing developers now potentially reviewing adoption of product solutions within their house designs.

“Fundamentally changing a heating system which has been commonplace since the 1970s is a huge undertaking! It presents numerous challenges, but it also presents plentiful opportunities. At Polypipe, we are working in partnership with our customers to explore these improvements and efficiencies in the construction process as part of introducing innovative technologies to give the UK construction industry real solutions to tomorrow’s problems.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.