Builders’ merchants’ sales fall in Q3: BMBI

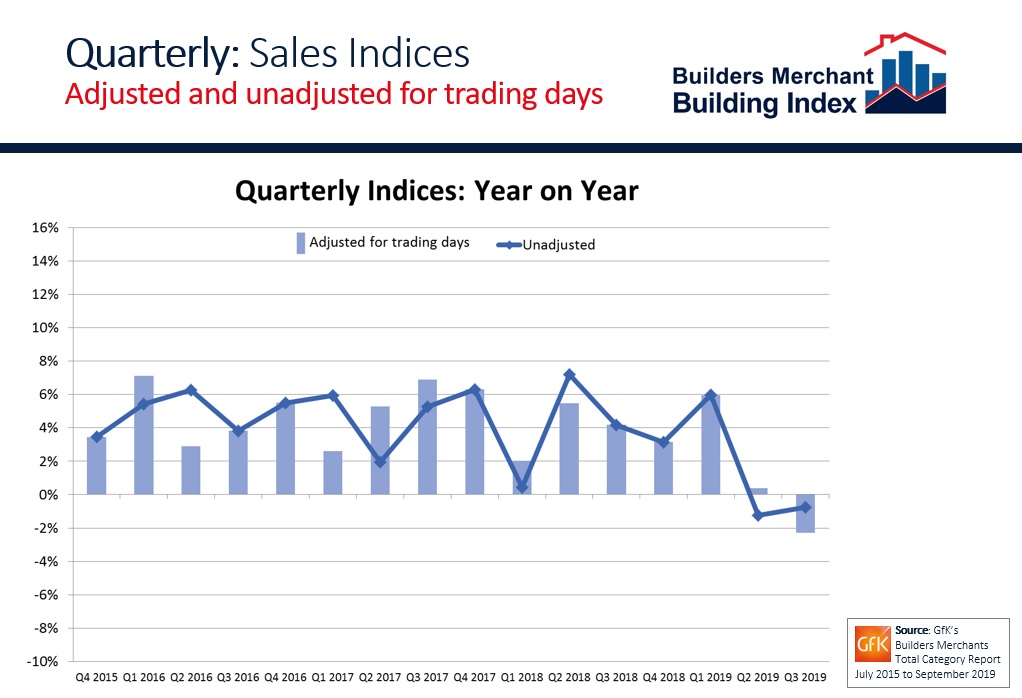

Total Builders’ Merchants’ value sales to builders and contractors were down -0.8% in quarter three compared to the same period last year, while the adjusted figure, which takes into account the difference in trading days, was down -2.3% compared with Q3 2018, BMBI stats show.

Merchants’ sales of Heavy Building Materials (the largest category) declined marginally by -0.4% year-on-year, while Timber & Joinery was down by -4.7% over the same period.

Kitchens & Bathrooms was among the strongest categories with growth of +3.2% in Q3.

Compared with Q2 2019, Total Builders’ Merchants’ sales saw marginal growth of +0.2% in quarter three. However, when adjusted for the four additional trading days, the figures showed a sales decline of -6.0%, marking the second consecutive quarter with negative growth.

Merchants’ sales of both Heavy Building Materials (-5.5%) and Timber & Joinery (-6.5%) fell quarter-on-quarter.

September’s BMBI index was 118.9, with Landscaping (125.3) the top performing category.

Andrew Simpson, National Commercial Director Hanson Cement and BMBI’s Expert for Cement & Aggregates (pictured), commented: “The Mineral Products Association reported that seasonally-adjusted demand for construction products improved in Q3 compared to Q2.

“Mortar sales were up 5.2% followed by asphalt (4.1%), aggregates (1.7%) and Ready Mixed Concrete (RMC), up 1.4%.

“This is an improvement, but the construction market is still weak. For instance, RMC is the biggest sales channel for cement, so it’s a concern that important markets such as London and the South East are in decline year-on-year.

“These two markets account for about a third of GB demand with volumes now 10% lower than 2018. The underlying problem is the decline in commercial projects and the postponing of infrastructure projects.

“These can be directly linked to Brexit and political uncertainty which are stifling investment and delaying decisions. It could be some time before confidence and investment returns.

“Sales to builders’ merchants have been difficult to predict. Wet weather has been a factor, but many merchants report lower order books and a slowing in demand.

“With continued political uncertainty and heavy rains this autumn, Q4 will be a challenge.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk

t: 01453 521 621

e: [email protected]

Visit Supplier's page

Latest news

19th April 2024

ASSA ABLOY: Access solutions can impact sustainability performance across the full life-cycle of a building

Embedding sustainability within any organisation requires a broad, strategic perspective. Scrutiny should include the physical infrastructure itself: According to the IEA, buildings consume around 30% of global energy*. ASSA ABLOY has more…

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Regulations & Accreditations, Building Services, Case Studies, Doors, Facility Management & Building Services, Information Technology, Research & Materials Testing, Retrofit & Renovation, Security and Fire Protection, Sustainability & Energy Efficiency, Video of the Week

19th April 2024

British weather doesn't dampen spirit for new HMG Garden Paint

Despite one of the wettest starts to the year on record, customers are starting to plan for brighter days with HydroPro Garden Paint from HMG Paints.

Posted in Articles, Building Industry News, Building Products & Structures, Garden, Innovations & New Products, Paints, Paints, Coatings & Finishes, Restoration & Refurbishment, Retrofit & Renovation, Site Preparation, Sustainability & Energy Efficiency, Waste Management & Recycling

18th April 2024

Abloy UK showcases new digital portfolio at The Security Event 2024

Abloy UK is set to unveil its latest line-up of access control systems at The Security Event 2024, welcoming guests to explore its cutting-edge electromechanical and digital solutions on stand 5/F50.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Doors, Exhibitions and Conferences, Facility Management & Building Services, Health & Safety, Information Technology, Retrofit & Renovation, Security and Fire Protection

18th April 2024

Strand is a Failsafe Choice for Emergency Exit and Panic Hardware

In times of emergency, you’re in safe hands with Strand Hardware. Although there are many considerations for building specification, few decisions can be as critical as selecting the right emergency exit/panic hardware.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection

Sign up:

Sign up: