Merchant sales collapse under COVID-19 lockdown – BMBI

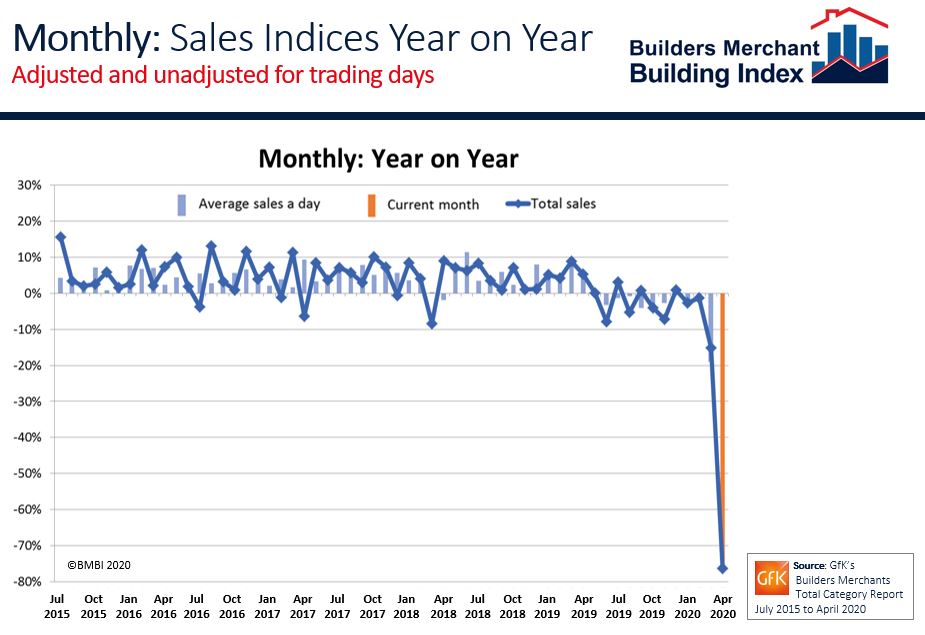

April’s BMBI report is unlike any other; the Government enforced COVID-19 lockdown came late in March, so had a limited impact on that month. However, April took the full force, with many trades not working and most merchants temporarily closing branches or providing a restricted service only for essential sectors or emergencies. As a result, this report contains unprecedented figures.

Year-on-year

Total Builders Merchants value sales to builders and contractors in April were down 76.3% compared with April 2019. All categories saw heavy falls, with Workwear & Safetywear least affected (- 60.2%), and Tools (- 90.0%) hit hardest. Kitchens & Bathrooms (- 86.8%) and Decorating (-81.6%) were also particularly weak.

Month-on-month

Total merchant value sales in April were 72.1% below March 2020, with two less trading days. All categories were severely hit with Services (- 59.0%) and Landscaping (- 64.5%) the least affected. Tools (- 87.4%) and Kitchens & Bathrooms (- 85.3%) were weakest.

Average sales a day, which removes trading day differences, were 69.3% lower overall than in March.

Other periods

Sales in the first four months of 2020 were 25.2% lower than in January to April 2019, with one more trading day this year.

Workwear & Safetywear (+4.4%) was the only category that sold more, having experienced a significant uplift in March driven by strong demand for protective equipment.

Index

April’s BMBI index was 29.0 and all categories were well down.

Malcolm Gough, Group Sales & Marketing Director Talasey Group and BMBI’s Expert for Natural Stone Landscaping Products, Vitrified Paving & Artificial Grass, commented on the statistics.

Malcolm Gough, Group Sales & Marketing Director Talasey Group and BMBI’s Expert for Natural Stone Landscaping Products, Vitrified Paving & Artificial Grass, commented on the statistics.

“Approaching Easter, we were set for our best year ever. We had a positive weather forecast, full stock levels and new product lines. Then, at the peak of the season, COVID-19 struck, and the market was shut.

“We continued to service a few customers and dealt with continuing demand for artificial grass, but in this ‘box-moving’ world it was a nightmare for China to lockdown first.

“The previous shortage of containers became even greater as they all backed up in China. We also had to land newly-arrived Indian sandstone, organise transport in a fraught market and get product to distribution centres.

“Prices from China have started to rise due to a combination of exchange rates, shipping costs and raw material costs. Prices of Indian sandstone are also expected to rise as the lockdown in India halted production.

“Manufacture of the popular Italian porcelain has stopped, although there is no sign of pressure on prices.

“As a result of this crisis, millions of homeowners have never spent so much time looking so long and so closely at their homes. The outcome is a surge of interest in improving them.

“If they can’t spend money on a holiday this year, they may spend it on their gardens. April’s traditional demand spike for all landscaping lines could be pushed back to August.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. F

or the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk

t: 01453 521 621

e: [email protected]

Visit Supplier's page

Latest news

24th April 2024

The lowdown on Origin’s New Soho Offering

Origin’s Soho External Door is the first launch in its new generation of products, setting a higher standard for the fenestration industry.

Posted in Access Control & Door Entry Systems, Aluminium Products, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Systems, Doors, Innovations & New Products, Posts, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection

24th April 2024

Mitsubishi Electric welcomes new code of conduct for smart appliances

Mitsubishi Electric welcomes a new code of conduct on energy smart appliances which the European Union (EU) announced yesterday at the Hannover Fair in Germany.

Posted in Air Conditioning, Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Regulations & Accreditations, Building Services, Exhibitions and Conferences, Facility Management & Building Services, Heating Systems, Controls and Management, Heating, Ventilation and Air Conditioning - HVAC, Plumbing, Retrofit & Renovation, Seminars, Sustainability & Energy Efficiency

24th April 2024

Hamworthy Heating expands CIBSE approved CPD modules with new hot water series

Hamworthy Heating, technical experts in commercial heating and hot water products, announce the expansion of its market leading CIBSE approved Continuing Professional Development (CPD) portfolio with the launch of three new learning modules.

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Continuing Professional Development (CPD's), Facility Management & Building Services, Heating Systems, Controls and Management, Heating, Ventilation and Air Conditioning - HVAC, Plumbing, Retrofit & Renovation, Seminars, Training

24th April 2024

New technology partnership brings Passivent ventilation products to IESVE

Passivent has partnered with Integrated Environmental Solutions (IES) to make a number of its products available to model within the Virtual Environment (VE) platform IESVE.

Posted in Air Conditioning, Articles, Building Industry News, Building Products & Structures, Building Services, Facility Management & Building Services, Heating, Ventilation and Air Conditioning - HVAC, Information Technology, Innovations & New Products, Posts, Retrofit & Renovation, Roofs, Ventilation

Sign up:

Sign up: