What’s the best way to fund your building project?

With many different finance options out there, it can be really difficult to know what type of funding you need for your building project – this article will go through some of the most common finance facilities and will outline what type of projects each one is suitable for.

The right finance facility for your project depends on a few different factors:

– How much you need to borrow

– The length of time you need to borrow the money for

– The type of project

– Your planned repayment strategy

Bridging Finance

Bridging finance is a short-term lending facility with typical loan terms of up to 12 months. Bridging is well-known for being a useful finance facility for property purchases, but it can also be ideal for smaller building projects like property refurbishments, building extensions, or property conversions.

Bridging loans can also be used for ground-up development projects as long as the work and sale/refinance can be completed within the slightly shorter timeframe that comes with bridging.

If you’re doing some renovations on an existing property that you own, the bridging loan can be secured against this property if there’s enough equity in it (the percentage of the property that you own outright).

If there isn’t sufficient equity in that property, then the loan can be secured against another property that you own instead.

If you want to use a bridging loan for a ground-up development project, then you will need to have other properties to use as security.

Bridging finance requires a concrete exit strategy, so you will need to have a plan of either selling a property or refinancing the loan with a mortgage product.

To find out whether bridging is right for you, as well as the costs involved, use an online bridging loan calculator.

Development Finance

Development finance is a finance facility designed for bigger, longer-term development projects. Although it can be paid off earlier, development finance facilities will usually be set up for a minimum term of 12 months.

This type of finance can be used to fund anything from property restoration and conversion projects, to ground-up house builds and large-scale hotel or factory developments.

The loan will be secured against a combination of the land you’re building on (if you own it) and the property/properties that you’re developing.

Additional properties may also be used as security if there isn’t sufficient equity in the property/properties and land that you’re developing.

A benefit of development finance is that it can be taken out in instalments. This means that an initial sum can be released to fund the land or property purchase, and then smaller amounts can be taken out in stages to cover the different building costs as they come along.

Like bridging, development finance requires a planned exit strategy to be in place. This is usually sale of the development or refinancing the loan on to a long-term mortgage product.

Secured Loan

Secured loans, also known as second charge mortgages, can be taken out for almost any legal reason so one can be used to fund renovation work on a property that you own.

Secured loans work like a mortgage, so it will be secured against your home (the renovations can be on a different property) on a second charge basis and paid back in monthly instalments over a long repayment term – sometimes up to 25 or 30 years.

This makes a secured loan suitable for building projects that don’t have a planned exit strategy, which you would need for a bridging loan or development finance.

Equity Release

Equity release is a loan that can be taken out when you’re over the age of 55. As the name suggests, it’s a finance facility which allows you to release the equity you’ve got in your home to give you a cash lump sum or the ability to access cash as and when you need it (this is known as a drawdown facility).

Any money released will be used to pay off the outstanding mortgage balance on your property, if you have one, and then it will be secured against the property in its place – this is why equity release is also known as a lifetime mortgage.

The difference however is that you don’t need to make any monthly repayments as the loan is repaid in full when your property is sold after you move into a permanent care facility or pass away.

The money released can be used for legal any purpose; some people use it to pay off debts, give their children an early inheritance, or go on a once in a lifetime holiday, but a very popular reason for taking out equity release is to fund home renovations.

So, whatever your building project is, there will be a funding solution out there which is suitable for you. If you’re unsure about what it is you’re looking for then make sure you seek independent financial advice.

Latest news

30th April 2024

Geberit exhibiting at British Pig & Poultry Fair 2024

Bathroom and piping manufacturer Geberit will be exhibiting at the British Pig & Poultry Fair at NEC Birmingham (15 – 16 May 2024).

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Exhibitions and Conferences, Facility Management & Building Services, Innovations & New Products, Pipes, Pipes & Fittings, Plumbing, Retrofit & Renovation

30th April 2024

Mitsubishi Electric and Chester Zoo partnership launch event

Chester Zoo and Mitsubishi Electric are set to announce an exciting new partnership that will see the zoo move one step closer to reach its ambitious goal of becoming net-zero by 2031.

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Case Studies, Exhibitions and Conferences, Facility Management & Building Services, Heating Systems, Controls and Management, Heating, Ventilation and Air Conditioning - HVAC, Plumbing, Retrofit & Renovation, Sustainability & Energy Efficiency

29th April 2024

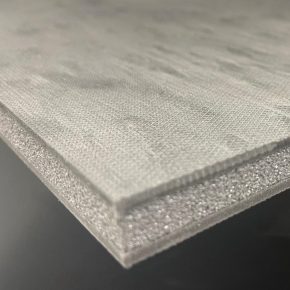

Hush: New Hushlay options offer acoustic upgrade potential

Leading UK acoustic systems manufacturer Hush Acoustics has introduced two additional variants of its Hushlay Soundmatting product.

Posted in Acoustics, Noise & Vibration Control, Articles, Building Industry News, Building Products & Structures, Building Services, Facility Management & Building Services, Floors, Innovations & New Products, Insulation, Restoration & Refurbishment, Retrofit & Renovation

29th April 2024

Digital Construction Week 2024 speaker programme announced

The programme at Digital Construction Week is carefully designed to help you keep up with the fast pace of innovation in the built environment.

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Exhibitions and Conferences, Innovations & New Products, news, Posts, Restoration & Refurbishment, Retrofit & Renovation, Seminars, Sustainability & Energy Efficiency

Sign up:

Sign up: