GUEST ARTICLE: Damage control – Households losing out on £475 to cover damage repairs

Brits fork out £475 on average to repair or replace a damaged item2 – up to 16 times more than the annual cost of accidental cover (£28.53)1, according to new research by MoneySuperMarket.

The study by the UK’s leading price comparison site analysed over 3,000,000 contents only and combined home insurance enquiries, revealing that 43% of enquirers choose not to include accidental damage cover.1 This is despite consumer research which shows that 62% of Brits say they or someone they live with has damaged an item to the point of needing to be repaired or replaced in the past 10 years.2

With UK households spending an extra 6.5 hours a day at home on average due to COVID-19 measures, almost one in six (16%) people are concerned about the risk of damaging contents at home.2 This rises to 27% for those living with someone under the age of 18, a third (30%) of who admitted they are concerned their children will damage items around the house with school closures in place.2

In line with these concerns, four in five (80%) Brits with children at home say that they or someone they live with has damaged an item in the last decade, compared to only 53% of those without.2 Those living with someone under 18 also paid 75% more on average to cover the cost of repairs than those with no children in the house (£638.50 vs £364.30).2

Analysing specific age groups, nearly half (49%) of contents insurance enquirers aged 18-34 opted not to include accidental damage cover1, despite being the age group most likely to say that items had been damaged accidentally at their house.2 Three quarters (75%) of 18 to 34-year-olds said at least one item had been damaged at home in the past 10 years, compared to just 57% of those aged 35 and over.2

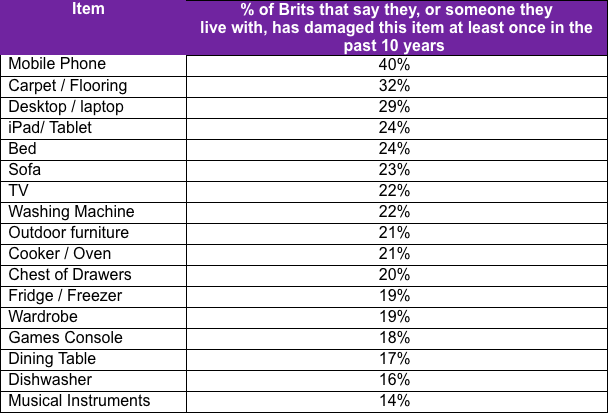

In terms of individual items, mobile phones are most likely to be damaged, with two in five (40%) households saying this has happened at least once in the past 10 years.2

Kate Devine, Head of Home Insurance at MoneySuperMarket, commented: ”With people spending more time at home due to social distancing measures, our research has shown there is concern about additional accidental damage occurring, particularly in those households with children at home.

“Ensuring you have a comprehensive home insurance policy in place which includes accidental damage cover will protect you from hefty prices for one-off repairs or replacements, and also give you some peace of mind.

“Just remember to check the single item limit on your policy and list any household items over that value. Typical items here could be jewellry, but also computers, antiques, musical instruments and designer goods.

“If you do need to make a claim, it is always worth comparing the cost to repair or replace the item against any excess you will need to pay and any loss to your no-claims discount.

“If you can pay for the repairs yourself your no-claims bonus won’t be affected which may result in lowering your home insurance premium.”

Sources

1) Date is taken from 3,261,197 MoneySuperMarket contents only and buildings and contents home insurance enquiry records, from the 1st January 2019 to 29th February 2020

2) Consumer research figures according to a survey of 2,000 UK adults, carried out by Opinium, between 1 – 4 of May 2020

Latest news

26th July 2024

Enfield Speciality Doors completes world-class project for Atlas Copco HQ

A rundown office and warehouse building completely transformed into a modern headquarters for Atlas Copco has been fitted with more than 120 internal fire doors from Enfield Speciality Doors.

Posted in Access Control & Door Entry Systems, Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Doors, Interior Design & Construction, Interiors, Posts, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Sustainability & Energy Efficiency, Timber Buildings and Timber Products, Wooden products

26th July 2024

Abloy UK launches new white paper

Abloy UK, a leading provider of security and access control solutions, has launched a new white paper.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Information Technology, Innovations & New Products, Publications, Research & Materials Testing, Security and Fire Protection

26th July 2024

MCRMA Member Profile: David Roy, Director of Roofconsult

David Roy of MCRMA member company Roofconsult has more than 50 years’ experience to draw upon working in the building envelope sector and a unique perspective on how it has changed in that time.

Posted in Articles, BIM, Infrastructure & CAD Software, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Services, Building Systems, Cladding, Information Technology, Restoration & Refurbishment, Retrofit & Renovation, Roofs, Walls

26th July 2024

Strand: Enhancing Door Functionality and Safety

Craig Fox, Sales Director for Strand Hardware, outlines how door industry professionals might apply door limiting stays…

Posted in Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: