BMBI: Builders’ Merchants’ April value sales down 0.9% despite 17% price inflation

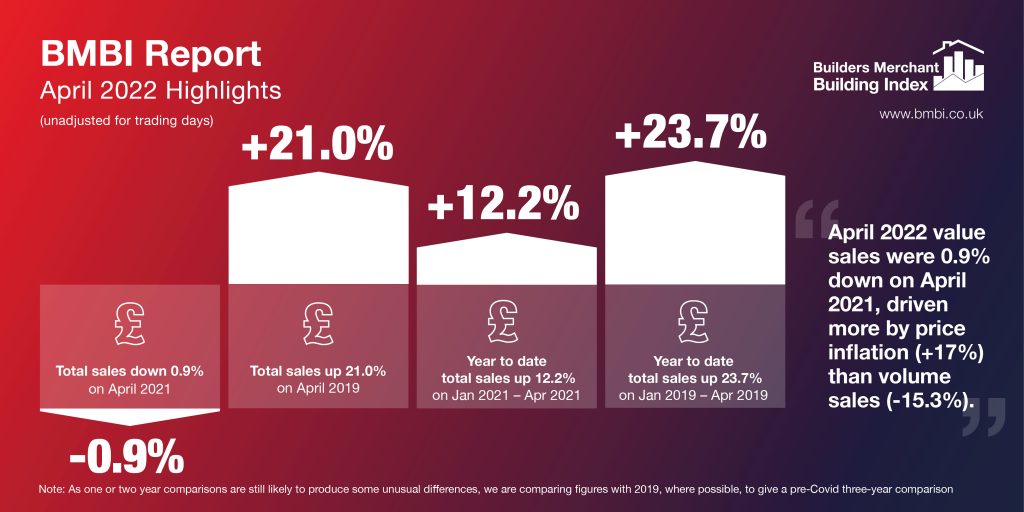

The latest figures from the Builders Merchant Building Index (BMBI) reveal builders’ merchants’ value sales in April 2022 were 0.9% down on the same month in 2021, the first decline since January 2021. Price inflation of +17.0% helped to mitigate April’s -15.3% drop in volume sales in comparison to April 2021.

Six categories did better than Merchants overall, with Kitchens & Bathrooms performing best (+15.8%). These include Heavy Building Materials (+2.2%) and Plumbing, Heating & Electrical (+6.7%). Landscaping (-14.1%) was weakest.

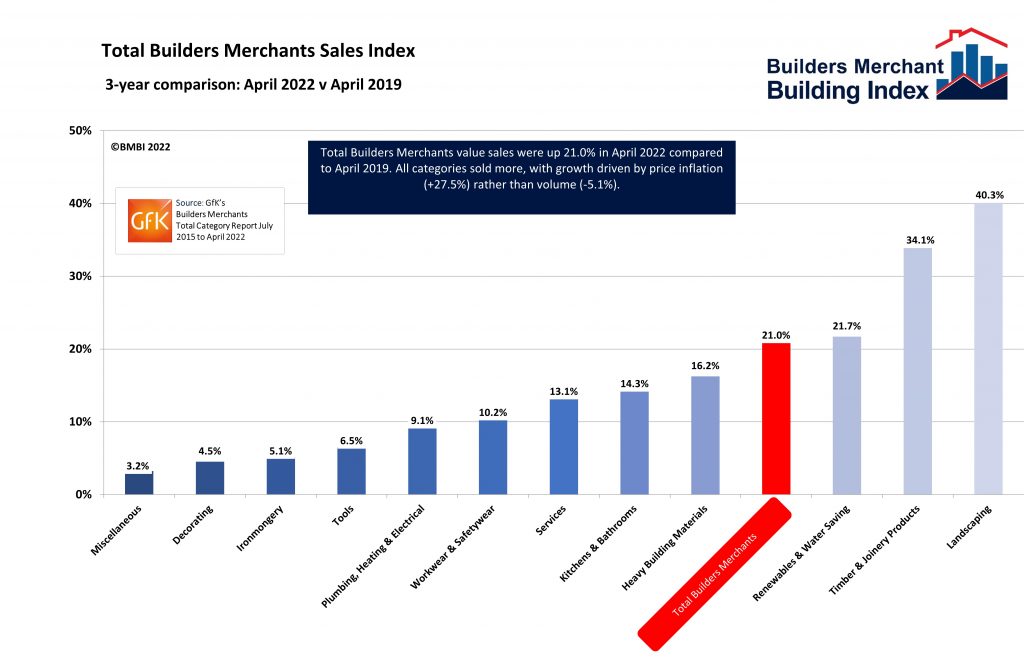

Compared to April 2019, a pre-pandemic year, total merchant value sales were 21.0% higher. All categories sold more driven by price inflation (+27.5%) rather than volume (-5.1%). Landscaping (+40.3%) and Timber & Joinery Products (+34.1%) performed best. Tools (+6.5%), Ironmongery (+5.1%) and Decorating (+4.5%) were among the categories which grew more slowly.

Year-to-date

Total sales in the period January 2022 to April 2022 were 12.2% up on the same period last year with one less trading day. All categories sold more. Kitchens & Bathrooms (+23.5%) was strongest, followed by Renewables & Water Saving (+21.2%). Timber & Joinery (+14.4%), Plumbing, Heating & Electrical (+14.0%) and Heavy Building Materials (+13.0%) also grew.

Compared to the same period in 2019, sales were 23.7% higher in the most recent period with one more trading day. All categories sold more with Timber & Joinery (+41.1%) and Renewables & Water Saving (+30.0%) performing strongly.

Month-on-month

However, month-on-month total merchant sales were 10.5% down in April 2022 compared to March 2022, with four less trading days. All bar one categories sold less, with the exception of Landscaping (+0.4%) which was flat.

Rolling 12-months

Total Merchants sales in the 12 months May 2021 to April 2022 were 19.3% higher than in the same 12 months a year earlier, with two less trading days. Eleven categories sold more, while Workwear & Safetywear was flat (-0.2%). Timber & Joinery Products (+33.7%) was strongest, with Kitchens & Bathrooms (+22.9%) and Renewables & Water Saving (+22.6%) also strong.

Paul Roughan, Sales Director at Dulux Trade and BMBI’s Expert for Paint, comments: “With inflation at a 30-year high, disposable incomes are being squeezed.

“The cost of living crisis is dominating headlines as annual inflation hit 9%, weakening demand across the sector. At the same time the market’s reaction was not as severe as expected and our own monthly total paint missed forecast for April by just 1.2%.

“Apart from holidays, home improvements are also a priority for many, with 40% of consumers planning to save to invest in their homes in 2022. Priority does not equal reality. With consumer wallets getting squeezed, priorities will be shifting based on what is affordable as the year progresses, which might have a significant effect on categories reliant on consumer spend.

‘Watchout’

“Within builders’ merchants, this particularly is a ‘watchout’ as the decorative category within builders’ merchant groups underperforms the market.

“In the short term, Trade is unlikely to soften further as surveys suggest 44% of painters and decorators are booked up five months and more in advance, with only 3% having no advance bookings. Retail sales are forecast to decline as the DIY boom softens with people returning to work, as well as considerable economic uncertainty over the next few years.

“The Trade Paint market on the other hand is forecast to see continued growth over the next few years, driven by new house building as well as commercial and private housing RMI.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: [email protected]

Visit Supplier's page

Latest news

26th April 2024

Hush Acoustics optimises fleet operations by securing FORS Gold accreditation

Hush Acoustics has invested in the safety and sustainability of its commercial vehicle fleet by achieving Gold status in the Fleet Operator Recognition Scheme (FORS).

Posted in Acoustics, Noise & Vibration Control, Articles, Building Industry News, Building Products & Structures, Building Regulations & Accreditations, Building Services, Ceilings, Facility Management & Building Services, Floors, Health & Safety, Insulation, Restoration & Refurbishment, Retrofit & Renovation, Site Preparation, Sustainability & Energy Efficiency, Walls, Waste Management & Recycling

26th April 2024

Safeguard Europe: Penetrating damp - how to diagnose the damage

As Safeguard gets ready to deliver another informative session of one of its most popular webinars, the company outlines some of the most common reasons for rain penetration through brickwork.

Posted in Articles, Bricks & Blocks, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Continuing Professional Development (CPD's), Damp & Waterproofing, Facility Management & Building Services, Information Technology, Posts, Render, Restoration & Refurbishment, Retrofit & Renovation, Seminars, Training, Walls

25th April 2024

ADSA: Competence Initiative Makes Progress

The Joint Competency Initiative (JCI), in which the Automatic Door Suppliers Association (ADSA) is involved, is finalising its first framework for installers within the door, gates and shutter industry.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Associations & Institutes, Building Industry Events, Building Industry News, Building Products & Structures, Building Regulations & Accreditations, Building Services, Continuing Professional Development (CPD's), Doors, Facility Management & Building Services, Health & Safety, Innovations & New Products, Publications, Research & Materials Testing, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Site Preparation

25th April 2024

BMBI: Value sales in first two months were -3.4% down

The latest Builders Merchant Building Index (BMBI) report shows builders’ merchants’ value sales were down -4.7% in February compared to the same month a year ago.

Posted in Articles, Bathrooms & Toilets, Bathrooms, Bedrooms & Washrooms, Bricks & Blocks, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Services, Civil Engineering, Concrete, Cement, Admixtures, Drainage, Floors, Hard Landscaping & Walkways, Interior Design & Construction, Interiors, Landscaping, news, Paints, Paints, Coatings & Finishes, Plant, Equipment and Hire, Plumbing, Posts, Publications, Research & Materials Testing, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency

Sign up:

Sign up: