BMBI: Builders’ Merchants’ May value sales up 14.8%

The latest figures from the Builders Merchant Building Index (BMBI), published in July, reveal that builders’ merchants’ value sales in May 2022 were up +14.8% compared to the same month in 2021, driven more by rising prices (+17.8%) than volume sales which were down -2.5% year-on-year.

All categories sold more in May 2022 compared to the previous year, with Kitchens & Bathrooms increasing the most (+29.7%). Six other categories fared better than merchants overall including Plumbing, Heating & Electrical (+21.6%), Heavy Building Materials (+20.6%) and Decorating (+16.5%). Tools (+11.9%), Ironmongery (+11.3%), Timber & Joinery Products (+6.8%) and Landscaping (+5.1%) grew more slowly. Like-for-like sales, which take into account the extra trading day in May 2022, were 9.1% higher.

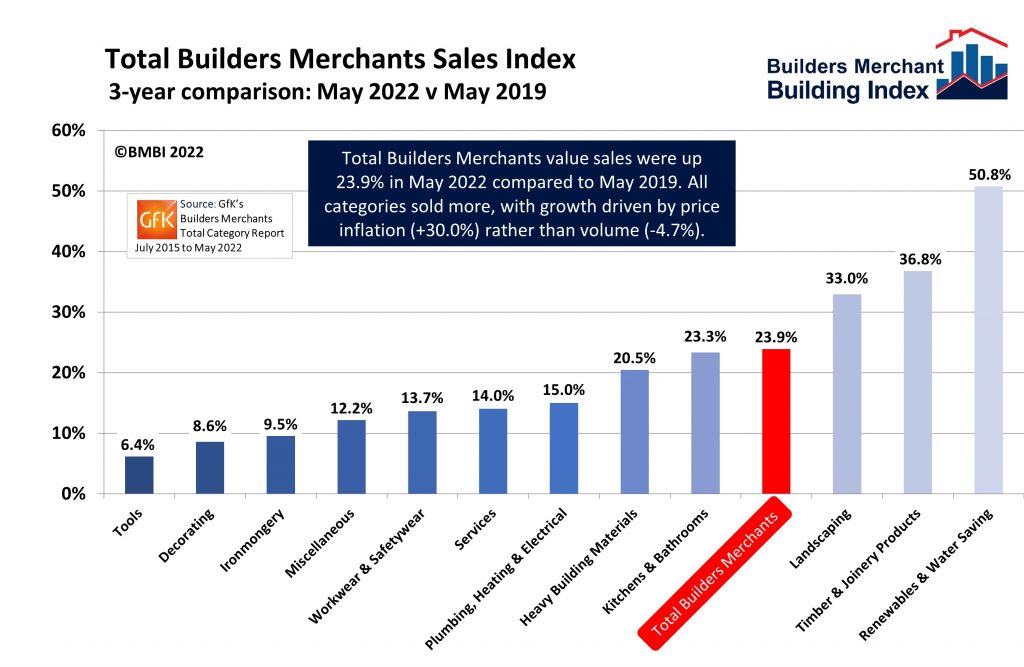

Compared to May 2019, a more normal pre-pandemic year, total merchant value sales were 23.9% higher with one less trading day in the most recent period. All categories sold more, with three outperforming total merchants: Renewables & Water Saving (+50.8%), Timber & Joinery Products (+36.8%) and Landscaping (+33.0%). Like-for-like sales were up +30.1%, while price inflation hit +30.0% and volumes were down -4.7%.

Year-to-date

Total sales in the period January to May 2022 were +12.8% higher than in January to May 2021. Price inflation was +16.6% up, while volume was down -3.3%. There was no difference in trading days. All categories sold more including Kitchens & Bathrooms (+24.8%), Renewables & Water Savings (+22.7%), Plumbing, Heating & Electrical (+15.4%) and Heavy Building Materials (+14.6%).

Compared to the same period in 2019, sales were 23.8% higher. Price inflation was up +25.4% and volume was down -1.3%. With two less trading days this year, like-for-like sales were 26.2% higher. All categories sold more led by Landscaping (+43.8%), Timber & Joinery Products (+38.4%) and Renewables & Water Saving (+32.7%).

Month-on-month

Month-on-month, total merchant sales were +8.7% up in May compared to April 2022, with one more trading day this year. All categories sold more, including Heavy Building Materials (+10.5%) and Kitchens & Bathrooms (+10.0%). Like-for-like sales were +3.3% up.

Rolling 12-months

Total Merchants sales in the 12 months June 2021 to May 2022 were 15.7% higher than in the same 12 months a year earlier, with one less trading day in the most recent period. Total like-for-like sales were 16.2% higher.

With price inflation of +15.7%, volume was effectively flat (+0.02%). Eleven of the twelve categories sold more. Timber & Joinery Products (+27.0%) grew most while Plumbing, Heating & Electrical (+15.0%), Heavy Building Materials (+13.6%) and Landscaping (+6.1%) all grew more slowly. Only Workwear & Safetywear (-1.1%) sold less.

Kevin Morgan, Group Commercial Director for The Crystal Group and BMBI’s Expert for PVC-U Windows & Doors (pictured below), comments: The war in Ukraine has amplified existing inflation and supply problems and added more pressure to energy costs when we were hoping to see improvements.

“The war has also knocked consumer confidence and total demand for windows and doors has started to fall. Rapid food and energy inflation has disproportionately hit homeowners with low or average incomes, and this is where volumes are falling the most. These ‘Have Not’ homeowners, many under 45, are now delaying non-critical home improvements, doing less while more confident DIYers are doing those they really need themselves to save on costs.

Forecasts

“Forecasts for the rest of the year and 2023 have been reduced following the events of Q1, but what we are increasingly seeing is a market of two parts which are still diverging, making the market as a whole harder to read. While demand among the ‘Have Not’ homeowners is dropping off, the ‘Haves’ continue to spend.

“The ‘Haves’ are mostly homeowners without mortgages or with low mortgages. They are predominantly older homeowners whose properties have been appreciating in value over the last 20 years. They account for the bulk of UK savings which increased significantly over the last two years, and they’re often referred to as the Bank of Mum & Dad. They have continued to spend on a range of home improvements and we hear that waiting lists for installers have got even longer.

“So, while there are challenges to overcome, there are clearly still opportunities for suppliers to the Haves and the DIY market, and for those selling into the New Build and commercial markets, which remain buoyant.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: [email protected]

Visit Supplier's page

Latest news

26th July 2024

Enfield Speciality Doors completes world-class project for Atlas Copco HQ

A rundown office and warehouse building completely transformed into a modern headquarters for Atlas Copco has been fitted with more than 120 internal fire doors from Enfield Speciality Doors.

Posted in Access Control & Door Entry Systems, Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Doors, Interior Design & Construction, Interiors, Posts, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Sustainability & Energy Efficiency, Timber Buildings and Timber Products, Wooden products

26th July 2024

Abloy UK launches new white paper

Abloy UK, a leading provider of security and access control solutions, has launched a new white paper.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Information Technology, Innovations & New Products, Publications, Research & Materials Testing, Security and Fire Protection

26th July 2024

MCRMA Member Profile: David Roy, Director of Roofconsult

David Roy of MCRMA member company Roofconsult has more than 50 years’ experience to draw upon working in the building envelope sector and a unique perspective on how it has changed in that time.

Posted in Articles, BIM, Infrastructure & CAD Software, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Services, Building Systems, Cladding, Information Technology, Restoration & Refurbishment, Retrofit & Renovation, Roofs, Walls

26th July 2024

Strand: Enhancing Door Functionality and Safety

Craig Fox, Sales Director for Strand Hardware, outlines how door industry professionals might apply door limiting stays…

Posted in Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: