BMBI: January merchant sales marginally up but volumes still down year-on-year

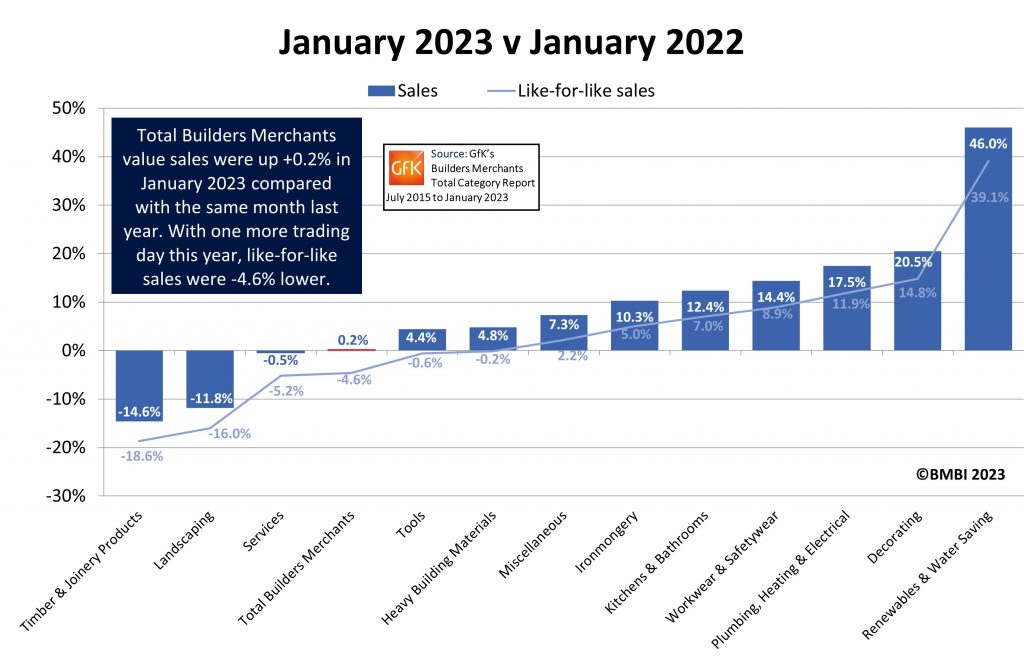

The latest figures from the Builders Merchant Building Index (BMBI) reveal builders’ merchants’ value sales were up +0.2% in January 2023, in comparison to the same month in 2022.

This nominal growth came from inflation as volume sales were down -16.5% while prices rose +19.9%. With an extra trading day this January, like-for-like sales were -4.6% lower.

Nine of the twelve categories sold more in January, in comparison to the previous year. Renewables & Water Saving (+46.0%) continued to perform strongly, while Decorating (+20.5%), Plumbing, Heating & Electrical (+17.5%), Workwear & Safetywear (+14.4%) and Kitchens & Bathrooms (+12.4%) also did better than overall sales. Heavy Building Materials grew more slowly (+4.8%). Timber & Joinery Products (-14.6%), Landscaping (-11.8%) and Services (-0.5%) all sold less.

Month on month

Month-on-month, total merchant sales were +31.1% higher in January 2023 than seasonal low month, December 2022. Volume sales also grew (+28.6%) with price slightly up (+1.9%). With five more trading days in January, like-for-like sales were flat (-0.1%). Renewables & Water Saving (+49.6%) grew the most, then Ironmongery (+38.0%), while Timber & Joinery Products (+33.9%) and Heavy Building Materials (+32.2%) also performed well.

Rolling 12-months

Total merchant sales in the twelve months from February 2022 to January 2023 were +5.3% up on the same period a year before. Price inflation was a double digit +16.5% while volumes were down -9.6%. With two less trading days in the most recent period, like-for-like sales were +6.2% higher. Ten of the twelve categories sold more with Renewables & Water Saving (+32.5%) and Kitchens & Bathrooms (+17.7%) the standout categories. Decorating (+11.4%) and Heavy Building Materials (+10.5%) also grew strongly, while Timber & Joinery Products (-5.0%) sold less.

‘A positive note’

Paul Edworthy, Commercial Lead: Builders Merchant Group; Dulux Trade and BMBI’s Expert for Paint, says: “2022 ended on a positive note with sales of Trade Paint being up for the 3rd consecutive month and by 1.3% compared to December 2021.

“Still, despite a buoyant Q4, the total volumes for the year finished 2.5% below 2021 and 2.7% below 2019 as would be expected following this years’ challenging economic climate.

“Looking ahead, there is still a lot of uncertainty about 2023 but everything points to construction output decreasing as investment in new projects slows down and in some cases halts due to increased interest rates, now standing at 4.25%.

“Interest rates increase the cost of construction materials, reduce the profits of construction companies as borrowing is more expensive, and reduce housing demand as mortgages becomes expensive.

“In terms of the housing market, as house prices fell for the fifth month in a row in January, demand for mortgages tumbled to its lowest level since the December 2020 COVID lockdown. House buyers are struggling with affordability, so we may see Housing RMI cool down even further. Since new and RMI Housing is the biggest volume contributor to construction output, this will most likely have a negative effect on the Trade Paints market in 2023.”

‘Topline trends’

Emile van der Ryst, Key Account Manager – Trade & DIY, GfK, which compiles the data for the BMBI report, adds: “Due to market turmoil in 2022, some of the monthly figures need further context. This month, January-on-January sees a +0.2% value increase, with a -16.5% volume decrease and a +19.9% price increase.

“Logic dictates that value should be around +3-4% if volume and price are balanced against each other. This month is however affected by Heavy Building Materials, Timber & Joinery and Landscaping distorting the total market view.

“These three categories make up around 75% of total market value and heavily influence topline trends but they are each quite different. Heavy Building Materials has one of the lowest average prices of the categories but has seen a larger than market average price growth.

“Timber & Joinery has one of the highest average prices, but has seen lower than market average volume declines, with prices declining against rampant total market inflation. Finally, Landscaping is a key volume driver in the market, but has seen a larger than market average seasonal volume decline.

“These factors in combination occasionally create hard-to-understand distortions, unexpected anomalies in topline trends which need to be seen in context.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: [email protected]

Visit Supplier's page

Latest news

26th July 2024

Enfield Speciality Doors completes world-class project for Atlas Copco HQ

A rundown office and warehouse building completely transformed into a modern headquarters for Atlas Copco has been fitted with more than 120 internal fire doors from Enfield Speciality Doors.

Posted in Access Control & Door Entry Systems, Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Doors, Interior Design & Construction, Interiors, Posts, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Sustainability & Energy Efficiency, Timber Buildings and Timber Products, Wooden products

26th July 2024

Abloy UK launches new white paper

Abloy UK, a leading provider of security and access control solutions, has launched a new white paper.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Information Technology, Innovations & New Products, Publications, Research & Materials Testing, Security and Fire Protection

26th July 2024

MCRMA Member Profile: David Roy, Director of Roofconsult

David Roy of MCRMA member company Roofconsult has more than 50 years’ experience to draw upon working in the building envelope sector and a unique perspective on how it has changed in that time.

Posted in Articles, BIM, Infrastructure & CAD Software, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Services, Building Systems, Cladding, Information Technology, Restoration & Refurbishment, Retrofit & Renovation, Roofs, Walls

26th July 2024

Strand: Enhancing Door Functionality and Safety

Craig Fox, Sales Director for Strand Hardware, outlines how door industry professionals might apply door limiting stays…

Posted in Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: