BMBI: Marginal value growth in year-on-year merchant sales in February

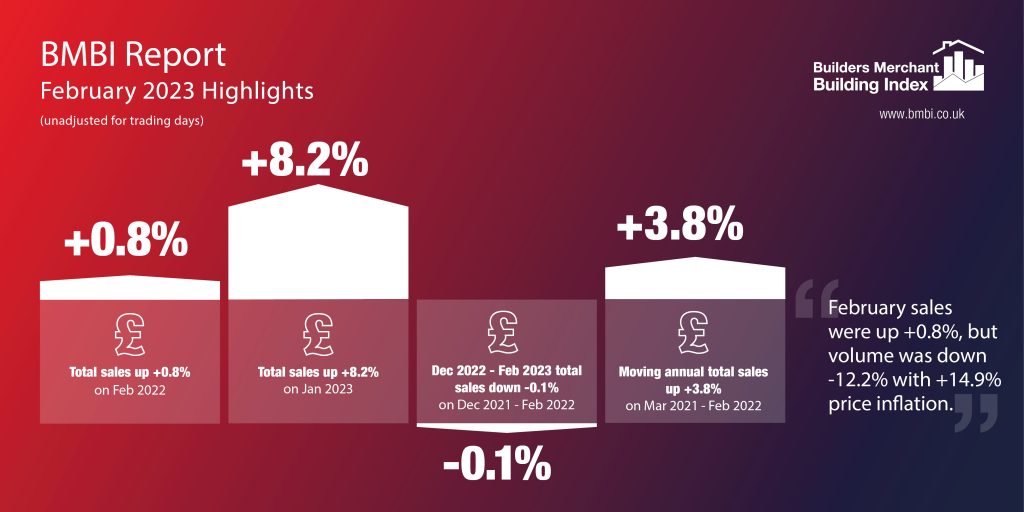

The latest figures from the Builders Merchant Building Index (BMBI), published in April, reveal builders’ merchants’ value sales were up +0.8% in February 2023 in comparison to the same month in 2022. This growth was driven exclusively by price inflation (+14.9%) as volume sales fell -12.2%. There was no difference in trading days.

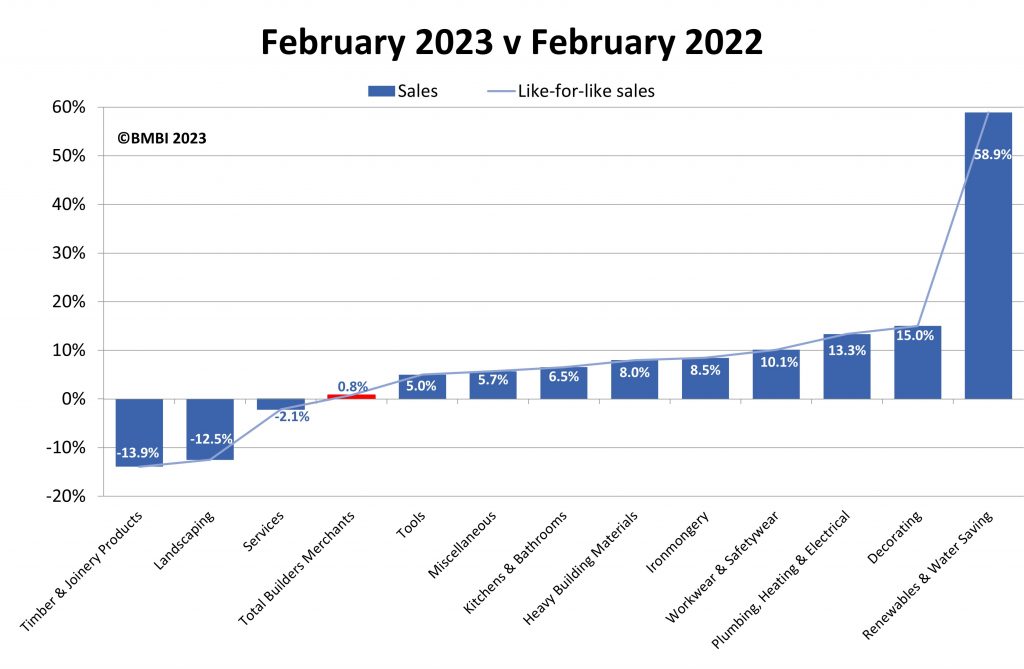

Nine of the twelve categories sold more in February 2023 compared to February 2022. Renewables & Water Saving (+58.9%) was again the strongest performing category, while Decorating (+15.0%), Plumbing, Heating & Electrical (+13.3%), Workwear & Safetywear (+10.1%) and Ironmongery (+8.5%) also increased. Heavy Building Materials grew more slowly (+8.0%) while Timber & Joinery Products (-13.9%), Landscaping (-12.5%) and Services (-2.1%) all sold less.

Month on month

Month-on-month, total merchant sales were +8.2% higher in February 2023 than the previous month. Volume sales were +13.4% higher than January, while prices were down -4.6%. With one less trading day in February, like-for-like sales were up +13.6%. Month-on-month the strongest category was Landscaping (+27.6%), followed by Heavy Building Materials (+10.9%). Workwear and Safetywear (-6.5%) was the weakest performing category.

Rolling 12-months

Total merchant sales in the twelve months from March 2022 to February 2023 were +3.8% up on the same period a year ago. Price inflation reached +16.6% while volumes were down -11.0%. With two less trading days in the most recent period, like-for-like sales were +4.7% higher. Ten of the twelve categories sold more with Renewables & Water Saving (+35.0%) continuing to lead the field. Kitchens & Bathrooms (+16.1%), Plumbing, Heating & Electrical (+14.6%), Workwear & Safetywear (+13.8%), Decorating (+11.5%) and Heavy Building Materials (+9.5%) all did better than merchants overall. Landscaping (-5.1%) and Timber & Joinery Products (-7.6%) both sold less.

‘Lacklustre’

Kevin Morgan, Group Commercial Director for The Crystal Group and BMBI’s Expert for PVC-U Windows & Doors, comments: “Window and door sales at the end of last year were pretty lacklustre for the industry as a whole, yet Q4 was our best quarterly sales of 2022. Much of this growth could be attributed to the success of our rapidly expanding ‘drop ship vending’ (DSV) model.

“While we may be one of the early adopters in the UK windows and doors sector, DSV is rapidly taking off in industries worldwide. Research suggests that third party online marketplaces will be the largest and fastest-growing retail channel globally between now and 2027.

“Sales through these online marketplaces – such as eBay and ManoMano – could account for as much as 59% of total global eCommerce in that time.

“For builders merchants, the DSV model allows them to add more products and unlimited choice to their online offer without having to hold additional stock.

“There are fewer touch points, and fewer opportunities for things to go awry. Third party suppliers like us simply fulfil orders and deliver directly to the customer while the merchant makes a commission.

“Younger, Millennial and Gen Z tradespeople want to order products online or on an app and have them delivered to site for maximum convenience and minimal effort. Merchants need to evolve the clicks and bricks model to appeal to this market.

“We are excited about what lies ahead with this broadest omnichannel approach. Talk of a recession may hit consumer spending, but there is always a solid base of customers with money to spend on home improvements. Until the cost of gas and electricity comes down, we’re likely to see a growing trend towards products with higher u-values to help cut energy bills.”

BMBI contact info

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

Latest news

26th July 2024

Enfield Speciality Doors completes world-class project for Atlas Copco HQ

A rundown office and warehouse building completely transformed into a modern headquarters for Atlas Copco has been fitted with more than 120 internal fire doors from Enfield Speciality Doors.

Posted in Access Control & Door Entry Systems, Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Doors, Interior Design & Construction, Interiors, Posts, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Sustainability & Energy Efficiency, Timber Buildings and Timber Products, Wooden products

26th July 2024

Abloy UK launches new white paper

Abloy UK, a leading provider of security and access control solutions, has launched a new white paper.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Information Technology, Innovations & New Products, Publications, Research & Materials Testing, Security and Fire Protection

26th July 2024

MCRMA Member Profile: David Roy, Director of Roofconsult

David Roy of MCRMA member company Roofconsult has more than 50 years’ experience to draw upon working in the building envelope sector and a unique perspective on how it has changed in that time.

Posted in Articles, BIM, Infrastructure & CAD Software, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Services, Building Systems, Cladding, Information Technology, Restoration & Refurbishment, Retrofit & Renovation, Roofs, Walls

26th July 2024

Strand: Enhancing Door Functionality and Safety

Craig Fox, Sales Director for Strand Hardware, outlines how door industry professionals might apply door limiting stays…

Posted in Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: