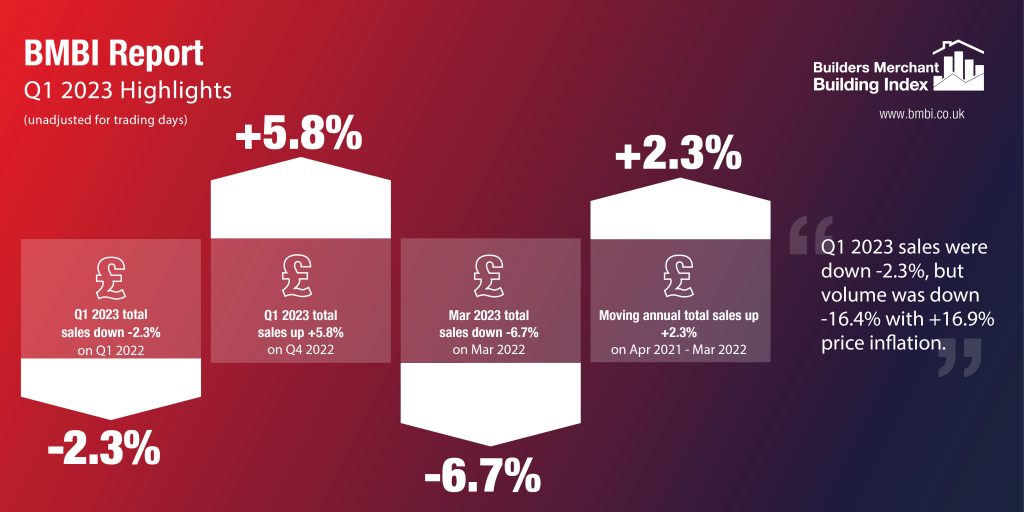

BMBI: Q1 2023 sales slip 2.3% as volumes fall 16.4%

The latest total value sales data from Britain’s Builders’ Merchants shows Q1 2023 recorded a -2.3% drop in year-on-year growth, with volume sales falling -16.4% countered by +16.9% price inflation. With one more trading day this year, like-for-like value sales were -3.8% lower. The BMBI has more…

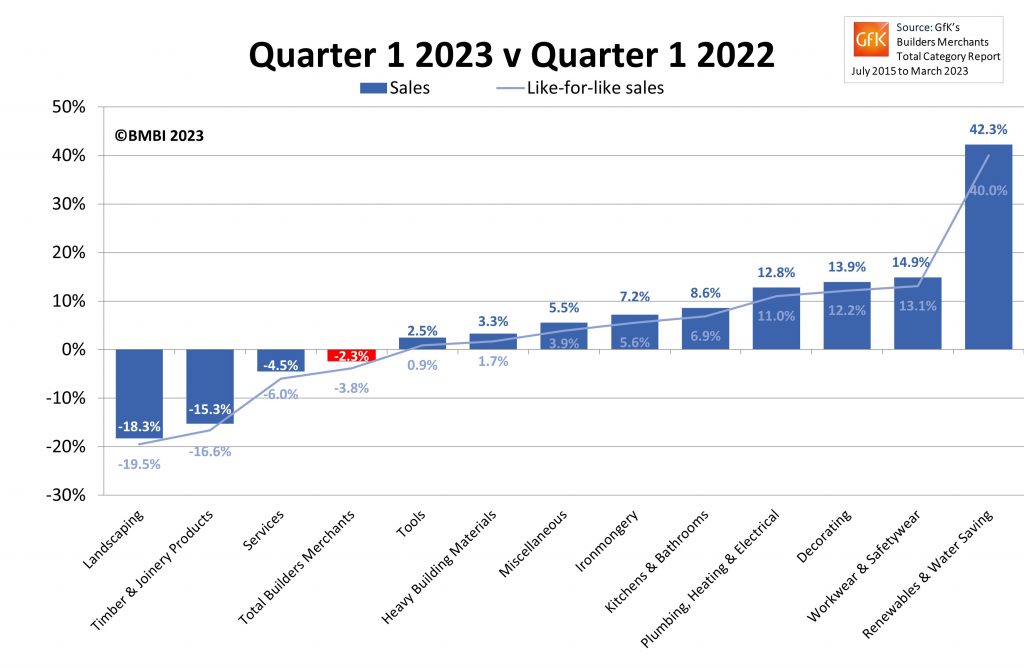

Quarterly sales, Year-on-Year

Nine of the 12 categories sold more in Q1 2023 compared to the previous year with Renewables & Water Saving (+42.3%) head and shoulders above the rest. Workwear & Safetywear (+14.9%), Decorating (+13.9%) and Plumbing, Heating & Electrical (+12.8%) also performed well while Heavy Building Materials (+3.3%) grew more slowly. Services (-4.5%), Timber & Joinery Products (-15.3%) and Landscaping (-18.3%) sold less.

Quarter-on-quarter

Total value sales were up +5.8% in Q1 2023 compared to Q4 2022. Volume sales edged up +0.6% and prices climbed +5.2%. With five more trading days in the most recent period, like-for-like sales were -2.5% lower than October to December 2022. Renewables & Water Saving (+22.3%) was the strongest category, followed by Tools (+11.8%), Ironmongery (+11.1%) and Heavy Building Materials (+6.4%). Services (-2.4%) was the weakest category.

March sales, Year-on-Year

Total value sales for March 2023 were -6.7% lower than March 2022. Volume sales fell -19.7% year-on-year and prices rose +16.2%. There was no difference in trading days. Seven of the 12 categories sold more with Renewables & Water Saving (+26.6%) again in the lead. Workwear & Safetywear (+19.7%), Plumbing, Heating & Electrical (+8.4%), Decorating (+7.9%) and Kitchens & Bathrooms (+7.3%) also grew. Tools (-1.1%), Heavy Building Materials (-1.6%), Services (-9.6%), Timber & Joinery Products (-17.0%) and Landscaping (-25.6%) sold less.

March sales, Month-on-Month

March total merchant sales were +14.8% ahead of February 2023. Volume sales were +13.2% higher and price inflation was up +1.4%. All categories sold more, with seasonal category Landscaping (+25.4%) increasing the most, followed by Workwear & Safetywear (+19.3%). Heavy Building Materials (+13.5%) also recorded double digit growth. Renewables & Water Saving (+4.9%) grew the least.

Last 12 months

April 2022 to March 2023 sales were +2.3% higher than the same 12 months a year earlier. Volume sales were -12.1% lower while prices increased +16.4%. With two less trading days this year, like-for-like sales were up +3.1%. Ten of the twelve categories sold more. Renewables & Water Saving was the best performing category (+35.1%) while Workwear & Safetywear (+15.2%) and Kitchens & Bathrooms (+14.5%) also fared well. Heavy Building Materials came middle of the pack (+8.3%) while Landscaping (-7.6%) and Timber & Joinery Products (-10.1%) both sold less.

BMBI Expert

Krystal Williams, Managing Director at Pavestone and BMBI’s Expert for Natural Stone & Porcelain Paving, says: “After a slow start, Q1 started to gather momentum in March as better weather laid the groundwork for a boost in paving sales.

“High-end landscapers are reportedly busy, however those working in the mid to lower end of the market, where the cost of living increases are more keenly felt, are seeing a drop in demand. There is also an increasing disparity between budgets and aspirations, so we may see more people opt to DIY their patio to save on labour.

“Porcelain continues to grow in popularity while sandstone sales are rolling backwards. As a premium product with premium benefits, homeowners will pay more for porcelain.

“Disappointingly though, we are already seeing a race to the bottom on pricing and quality.

“We recently identified an issue with paving products mis-claimed as porcelain. This fake product is not fired at high enough temperatures, so it is porous, therefore susceptible to algae and staining, and it’s not scratch or slip resistant.

“To avoid a flood of unhappy customers returning when problems inevitably begin to surface, we are doing some education work with merchants around this growing issue.

“Lighter colours are trending for 2023, including greige. We are offering a new porcelain with a marble pattern which is selling out fast, as customers seek out something different for their outdoor spaces.”

t: 01453 521 621

e: [email protected]

Visit Supplier's page

Latest news

26th July 2024

Enfield Speciality Doors completes world-class project for Atlas Copco HQ

A rundown office and warehouse building completely transformed into a modern headquarters for Atlas Copco has been fitted with more than 120 internal fire doors from Enfield Speciality Doors.

Posted in Access Control & Door Entry Systems, Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Doors, Interior Design & Construction, Interiors, Posts, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Sustainability & Energy Efficiency, Timber Buildings and Timber Products, Wooden products

26th July 2024

Abloy UK launches new white paper

Abloy UK, a leading provider of security and access control solutions, has launched a new white paper.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Information Technology, Innovations & New Products, Publications, Research & Materials Testing, Security and Fire Protection

26th July 2024

MCRMA Member Profile: David Roy, Director of Roofconsult

David Roy of MCRMA member company Roofconsult has more than 50 years’ experience to draw upon working in the building envelope sector and a unique perspective on how it has changed in that time.

Posted in Articles, BIM, Infrastructure & CAD Software, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Services, Building Systems, Cladding, Information Technology, Restoration & Refurbishment, Retrofit & Renovation, Roofs, Walls

26th July 2024

Strand: Enhancing Door Functionality and Safety

Craig Fox, Sales Director for Strand Hardware, outlines how door industry professionals might apply door limiting stays…

Posted in Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: