BMBI: Second best quarter on record but signs of a slowdown in sight

The latest total value sales data from Britain’s Builders’ Merchants show a continuation of the strong growth seen throughout 2021, with Q3 recording the second-highest quarterly BMBI sales ever. However, there are signs of a slowdown as volume growth gives way to value growth, driven by price increases.

Quarterly sales, Year-on-Year

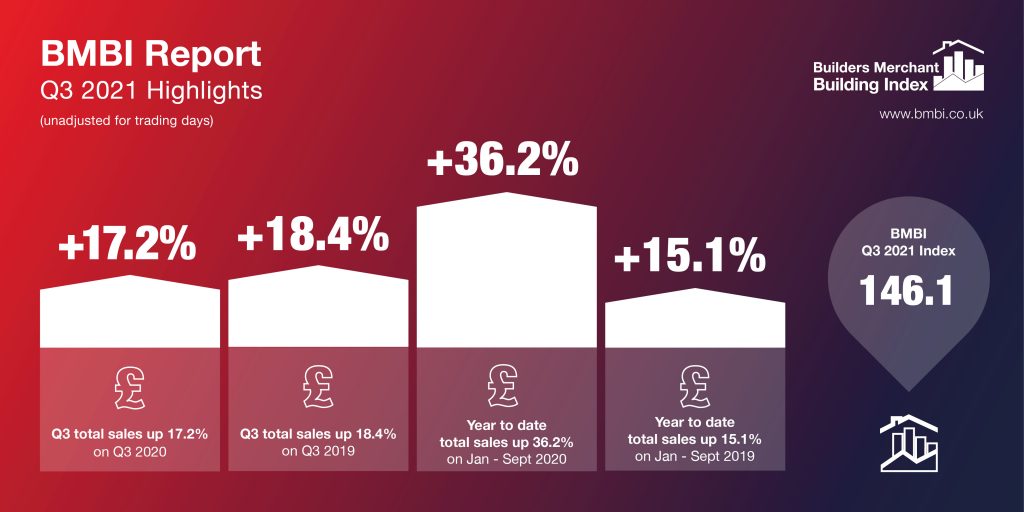

Total value sales to builders and contractors in Q3 2021 were 17.2% higher than Q3 2020, with one less trading day this year. Eleven out of the 12 product categories sold more over the period. Timber & Joinery Products led the field (+43.9%) with its highest-ever quarterly BMBI sales, contributing significantly to overall growth. Excluding Timber, total merchant sales still grew by 9.6%. Like-for-like-sales increased by 19.1%.

Over the same period, product categories Kitchens & Bathrooms (+12.3%), Plumbing, Heating & Electrical (+11.6%) and Heavy Building Materials (+11.2%) also grew strongly.

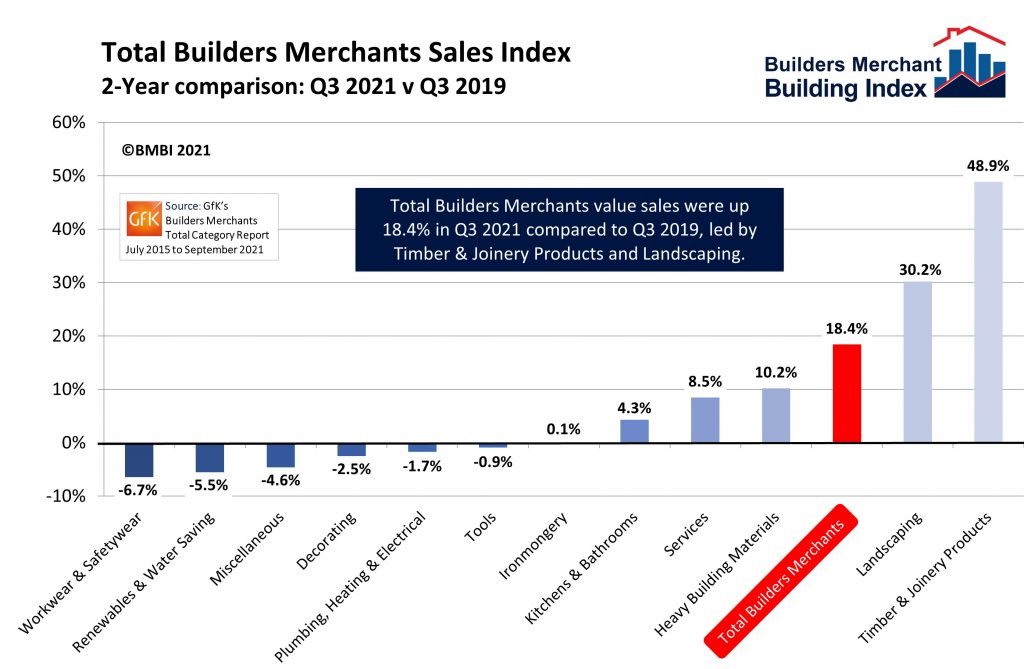

Comparing Q3 2021 with Q3 2019, a more normal pre-COVID year, overall value sales were up 18.4% with one less trading day this year. Six categories sold more, led by Timber & Joinery Products (+48.9%) and Landscaping (+30.2%). Like-for-like sales were up 20.2%.

Quarter-on-quarter

Quarter-on-quarter, sales were down 2.4% in Q3 compared to Q2, despite the three extra trading days in Q3. Five of the 12 product categories sold more in Q3. Kitchens & Bathrooms (+7.4%) and Timber & Joinery (+4.8%) performed best, while Landscaping was weakest (-22.5%). Like-for-like sales were 7.0% lower than in Q2.

September sales, Year-on-Year

Total sales were up 14.9% in September 2021 compared to September 2020. Timber & Joinery Products (+38.7%) did best as it continues to outperform other categories.

Total value sales in September 2021 were 24.5% higher than the same month two years ago, with one more trading day this year. Much of this growth is due to Timber & Joinery Products (+54.1%) and Landscaping (+40.2%). Without these two categories in the calculations, the two-year growth is still strong at +13.3%.

September sales, Month-on-Month

Total merchant sales in September were 6.2% higher than August, with one more trading day, contributing to Q3’s overall performance. All bar one category sold more.

Year-to-date

Year-to-date value sales for January to September 2021 are up 36.2% in value against 2020, which is noticeably ahead of growth forecasts made at the beginning of the year. Compared to 2019, a more accurate benchmark, year-to-date growth is up by 15.1%.

Timber & Joinery Products and Landscaping continued their astounding growth. Timber & Joinery year-to-date sales are up 61.4% against 2020 and 35.7% against 2019, while Landscaping is up 35.9% against 2020 and 37.9% against 2019. Heavy Building Materials is also up by 28.6% against 2020 and 7.9% against 2019.

Index

The Q3 BMBI index was 146.1, with nine of the 12 product categories exceeding 100. Timber & Joinery (191.9) and Landscaping (184.0) continue to outperform other categories by some margin. However, Heavy Building Materials (133.3), Ironmongery (126.2) and Kitchens & Bathrooms (125.3) also did well. Renewables was the weakest category (71.2).

Paul Roughan, Trade Merchants Sales Director Dulux Trade and BMBI’s Expert for Paint, comments:

Paul Roughan, Trade Merchants Sales Director Dulux Trade and BMBI’s Expert for Paint, comments:

“It has been another difficult quarter, as the industry grapples with labour and materials supply issues. Job vacancies are at a record high and supply chain problems facing the UK have led to a fall in construction output for four consecutive months. This is likely to have an impact downstream on the trade paint market as these are problematic for our major customers.

“Early in Q3, demand stayed strong within the trade as total market volume for August 2021 was only slightly down (-4%) compared to the same month last year. On a moving annual totals (MAT) basis though, volumes were up 14% year-on-year and we were still 4.6% to the good versus the MAT volume for August 2019 – a more normal pre-COVID period.

Change

“However, change is in the air. According to figures from the British Coatings Federation, trade paint sales in September were down 15% against September sales last year, following what they called ‘lacklustre’ performances in each of the previous three months.

“The downward trend was replicated in the decorative paint market, where September was down 26% year-on-year, following a run of falls since May this year as consumer confidence faltered and the property boom from earlier in the year started to fizzle out.

“Despite the gloom, year-to-date trade paint sales for 2021 are still up by more than 8% compared to last year. Is it a big ask to maintain this as we move into Q4? Maybe, maybe not. The CPA expects construction growth to stay strong for the rest of the year, so much will depend on the industry’s ability to overcome the frustrations of supply shortages, bottlenecks at ports and mounting cost pressures.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: [email protected]

Visit Supplier's page

Latest news

26th July 2024

Enfield Speciality Doors completes world-class project for Atlas Copco HQ

A rundown office and warehouse building completely transformed into a modern headquarters for Atlas Copco has been fitted with more than 120 internal fire doors from Enfield Speciality Doors.

Posted in Access Control & Door Entry Systems, Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Doors, Interior Design & Construction, Interiors, Posts, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Sustainability & Energy Efficiency, Timber Buildings and Timber Products, Wooden products

26th July 2024

Abloy UK launches new white paper

Abloy UK, a leading provider of security and access control solutions, has launched a new white paper.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Information Technology, Innovations & New Products, Publications, Research & Materials Testing, Security and Fire Protection

26th July 2024

MCRMA Member Profile: David Roy, Director of Roofconsult

David Roy of MCRMA member company Roofconsult has more than 50 years’ experience to draw upon working in the building envelope sector and a unique perspective on how it has changed in that time.

Posted in Articles, BIM, Infrastructure & CAD Software, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Services, Building Systems, Cladding, Information Technology, Restoration & Refurbishment, Retrofit & Renovation, Roofs, Walls

26th July 2024

Strand: Enhancing Door Functionality and Safety

Craig Fox, Sales Director for Strand Hardware, outlines how door industry professionals might apply door limiting stays…

Posted in Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: