UK construction output drops in June but FTSE nears record high

UK Construction output has fallen in June by 0.9% according to the latest revised figures released by the Office of National Statistics (ONS) – however there is “little anecdotal evidence” to suggest that the run up to the EU referendum on June 23rd had any impact.

Construction output is a monthly estimate of the industry’s performance in both the public and private sectors. Output is defined as the amount charged by construction companies to customers for the value of work produced during the reporting period, minus VAT and payments to sub-contractors.

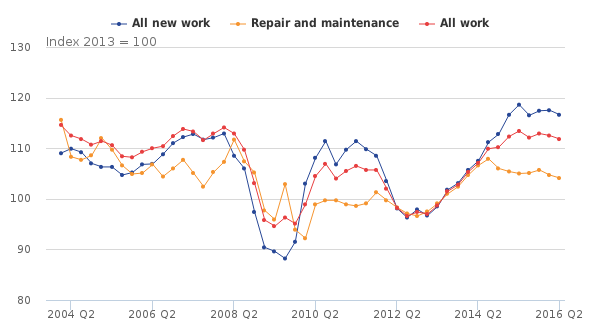

Despite a positive outlook in April, the construction sector’s output in Quarter 2 (April to June) 2016 is estimated to have decreased by 0.7% when compared with Quarter 1 (January to March) 2016 and by 1.4% when compared to Quarter 2 2015.

The decline during Quarter 2 is the result of a fall in all new work, which decreased by 0.8%, and repair and maintenance, which dropped 0.5%.

Compared with Quarter 2 2015, all work decreased by 1.4%, the first year-on-year decrease since Quarter 1 2013. Source: Construction – Output and Employment – Office of National Statistics.

The fall in output follows the latest Markit/CIPS construction purchasing managers’ index (PMI) which showed that the construction industry recorded its sharpest fall since June 2009 last month, with a reading of 45.9 in July.

The UK construction PMI also revealed that incoming new work has declined at its steepest pace since December 2012, with residential and commercial activity suffering the greatest.

The report suggested that the downturn in business activity was down to uncertainty ahead of the EU referendum in June, which caused “widespread delays to investment decisions and housing market jitters”.

A number of construction firms commented that clients were reluctant to commence new contracts until the general economic outlook became more clear.

FTSE 100 heading towards all-time record

JPMorgan, one of the biggest critics of Brexit before the referendum, now thinks UK shares are one of the most attractive destinations for global investors, with the FTSE 100 best placed to outstrip other stock markets, especially in Europe.

The FTSE 100 is now heading towards its all-time record 7089.77 close, reached in April 2015.

UK property inquiries ‘up 25% after Brexit’

Inquiries about purchasing British properties from investors in Qatar, Saudi Arabia and the UAE have seen a 25% increase in the wake of the UK vote to leave the European Union (EU), according to global real estate services firm DTZ. Full story from ME Construction News.

Brexit will create more efficient UK buildings

Architect Ken Shuttleworth who worked with Foster + Partners for nearly 30 years, including on flagship projects such as London’s ‘Gherkin’ says the UK’s Brexit decision will push greater efficiency in buildings. He says, “There will be pressure, especially in a hiatus time, to be able to save expenditure.” Interview in Financial Review 15th August.

Latest news

26th April 2024

Hush Acoustics optimises fleet operations by securing FORS Gold accreditation

Hush Acoustics has invested in the safety and sustainability of its commercial vehicle fleet by achieving Gold status in the Fleet Operator Recognition Scheme (FORS).

Posted in Acoustics, Noise & Vibration Control, Articles, Building Industry News, Building Products & Structures, Building Regulations & Accreditations, Building Services, Ceilings, Facility Management & Building Services, Floors, Health & Safety, Insulation, Restoration & Refurbishment, Retrofit & Renovation, Site Preparation, Sustainability & Energy Efficiency, Walls, Waste Management & Recycling

26th April 2024

Safeguard Europe: Penetrating damp - how to diagnose the damage

As Safeguard gets ready to deliver another informative session of one of its most popular webinars, the company outlines some of the most common reasons for rain penetration through brickwork.

Posted in Articles, Bricks & Blocks, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Continuing Professional Development (CPD's), Damp & Waterproofing, Facility Management & Building Services, Information Technology, Posts, Render, Restoration & Refurbishment, Retrofit & Renovation, Seminars, Training, Walls

25th April 2024

ADSA: Competence Initiative Makes Progress

The Joint Competency Initiative (JCI), in which the Automatic Door Suppliers Association (ADSA) is involved, is finalising its first framework for installers within the door, gates and shutter industry.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Associations & Institutes, Building Industry Events, Building Industry News, Building Products & Structures, Building Regulations & Accreditations, Building Services, Continuing Professional Development (CPD's), Doors, Facility Management & Building Services, Health & Safety, Innovations & New Products, Publications, Research & Materials Testing, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Site Preparation

25th April 2024

BMBI: Value sales in first two months were -3.4% down

The latest Builders Merchant Building Index (BMBI) report shows builders’ merchants’ value sales were down -4.7% in February compared to the same month a year ago.

Posted in Articles, Bathrooms & Toilets, Bathrooms, Bedrooms & Washrooms, Bricks & Blocks, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Services, Civil Engineering, Concrete, Cement, Admixtures, Drainage, Floors, Hard Landscaping & Walkways, Interior Design & Construction, Interiors, Landscaping, news, Paints, Paints, Coatings & Finishes, Plant, Equipment and Hire, Plumbing, Posts, Publications, Research & Materials Testing, Restoration & Refurbishment, Retrofit & Renovation, Sustainability & Energy Efficiency

Sign up:

Sign up: