Hung Parliament: what does this mean for the housing market?

Naomi Heaton, Chief Executive of London Central Portfolio, looks at how the unexpected general election result might affect the UK housing market.

Given the unprecedented turn of events as the UK election results are announced, there will undoubtedly be an impact on the UK and London housing markets.

Whilst it is most likely that the Conservative party will form a coalition with the DUP to create a working majority, the UK looks set to face an extended period of uncertainty, historically unattractive to inward investment.

However, as it does not appear possible for Labour to form a rainbow coalition with the other remaining parties, the uncertainty caused by a possible second EU referendum may have receded. In addition, the weakened position of the Conservative party, in conjunction with a pro ‘soft-border’ DUP, would suggest that the UK will be on course for a softer Brexit.

This outcome may well be attractive both to institutions considering their position in the City of London and international investors looking at the UK, particularly as global events such as the Trump-Russia affair and continuing destabilisation in the Middle East is causing even greater economic and political flux outside the UK.

The diminished threat of Labour implementing aggressive tax and spend policies will also be welcome both to business and investor sentiment, taking the edge off uncertainty caused by these election results. Significant tax increases targeted at property investors that Labour might also have instituted are now less likely to occur.

Whilst sterling has rallied slightly in the early hours of today, it is now between 2% and 3% down against the dollar and euro from yesterday from an already weak position. This is likely to continue in the current political situation which may encourage more active investors to take advantage of discounted prices in the property and stock market.

Nevertheless, it is anticipated that transactions will continue to fall in Prime Central London whilst investors assimilate the new situation, particularly at the luxury end and in the new build sector, already battered through the introduction of new residential taxes.

For the domestic housing market, outside Prime Central London, the recent evidence of a downturn by most data analysts, due to concerns over a weakening UK economic position and rising inflation, is unlikely to be reversed in light of the current events.

Latest news

30th April 2024

ASSA ABLOY Door Group strengthens offering with partnership

ASSA ABLOY Door Group is proud to announce a new internal restructure that sees the company joining forces with all comparable business units across Europe, the Middle East, India and Africa, to form a new global division – the ASSA ABLOY EMEIA Door Business Segment.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection

30th April 2024

Geberit exhibiting at British Pig & Poultry Fair 2024

Bathroom and piping manufacturer Geberit will be exhibiting at the British Pig & Poultry Fair at NEC Birmingham (15 – 16 May 2024).

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Exhibitions and Conferences, Facility Management & Building Services, Innovations & New Products, Pipes, Pipes & Fittings, Plumbing, Retrofit & Renovation

29th April 2024

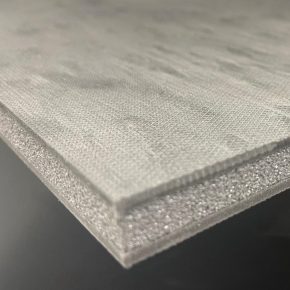

Hush: New Hushlay options offer acoustic upgrade potential

Leading UK acoustic systems manufacturer Hush Acoustics has introduced two additional variants of its Hushlay Soundmatting product.

Posted in Acoustics, Noise & Vibration Control, Articles, Building Industry News, Building Products & Structures, Building Services, Facility Management & Building Services, Floors, Innovations & New Products, Insulation, Restoration & Refurbishment, Retrofit & Renovation

29th April 2024

Digital Construction Week 2024 speaker programme announced

The programme at Digital Construction Week is carefully designed to help you keep up with the fast pace of innovation in the built environment.

Posted in Articles, Building Industry Events, Building Industry News, Building Products & Structures, Building Services, Exhibitions and Conferences, Innovations & New Products, news, Posts, Restoration & Refurbishment, Retrofit & Renovation, Seminars, Sustainability & Energy Efficiency

Sign up:

Sign up: