BMBI: Merchant value sales fall -9.0% in April as volumes drop -20.2%

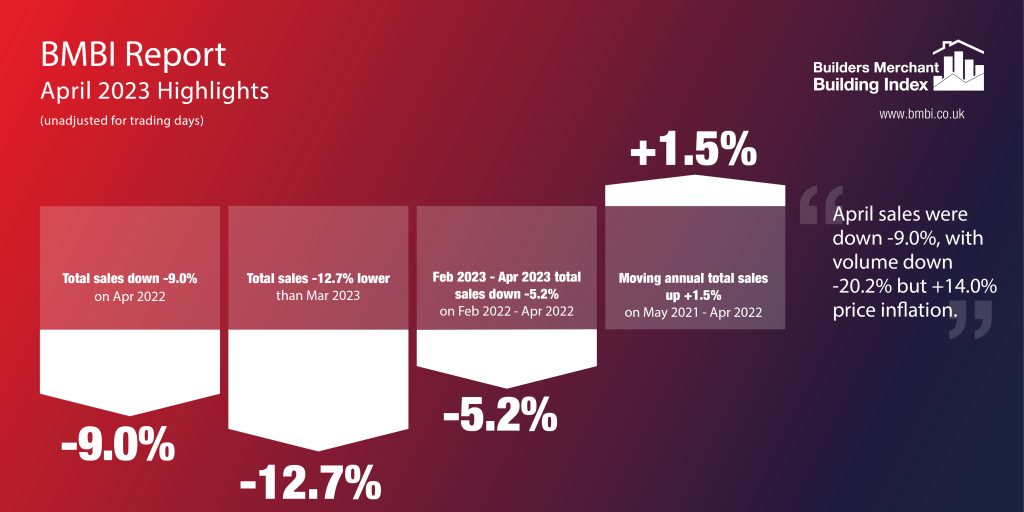

The latest figures from the Builders Merchant Building Index (BMBI) reveal builders’ merchants’ value sales were down -9.0% in April 2023, in comparison to the same month in 2022.

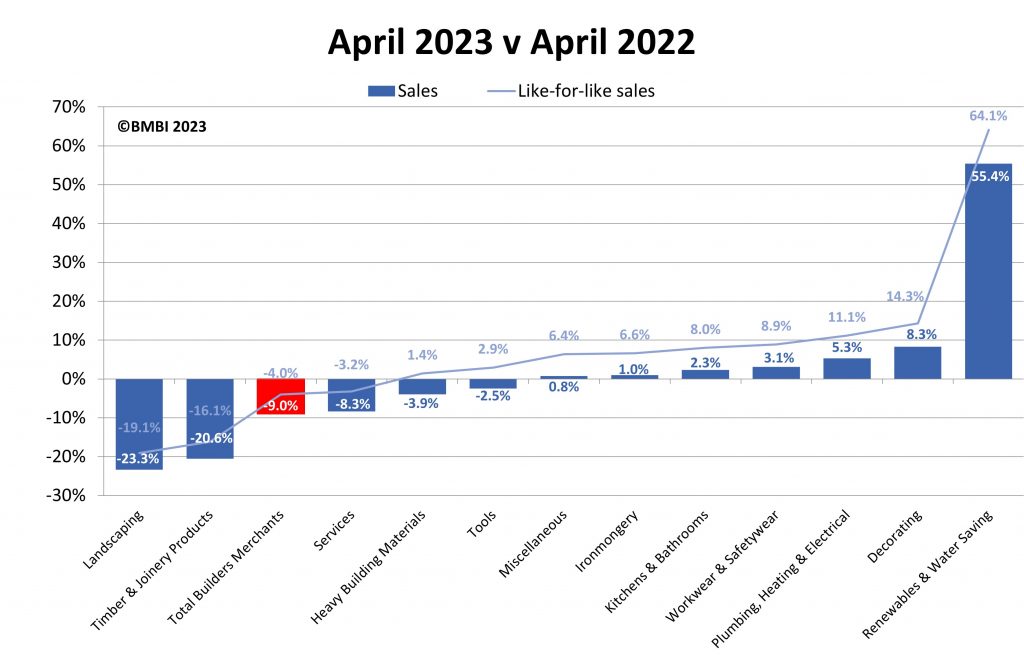

Volume fell -20.2% with price inflation of +14.0%. Taking trading day differences into account, like-for-like sales were -4.0% lower as April 2023 had one less trading day than the same month in the previous year.

Seven of the twelve categories sold more this year than in April 2022. Renewables & Water Saving (+55.4%) was the strongest performing category by some margin, followed by Decorating (+8.3%) and Plumbing, Heating & Electrical (+5.3%). Heavy Building Materials (-3.9%), Timber & Joinery Products (-20.6%) and Landscaping (-23.3%) all sold less.

Month on month

Month-on-month, total merchant sales were down -12.7% in April compared to March 2023. Volume sales were down -11.9% with prices registering a small decline of -0.9%. But with five less trading days in April, like-for-like value sales were up +11.6%. Landscaping (+3.3%) was the only category to sell more. Sales of the two largest categories, Timber & Joinery (-15.7%) and Heavy Building Materials (-12.3%) were down, while Plumbing, Heating & Electrical (-22.6%) and Workwear and Safetywear (-26.7%) were the worst performing categories.

Rolling 12-months

Total merchant sales in the twelve months from May 2022 to April 2023 were +1.5% higher than the same period a year ago. Volumes fell -12.5% with price inflation of +16.0%. With two less trading days in the most recent period, like-for-like sales were +2.4% higher.

Ten of the twelve categories sold more with Renewables & Water Saving (+39.9%) well ahead of Plumbing, Heating & Electrical (+13.6%), Kitchens & Bathrooms (+13.3%), Decorating (+12.2%) and Heavy Building Materials (+7.7%). Landscaping (-8.5%) and Timber & Joinery Products (-11.6%) both sold less.

Chris Fisher, VP (EMEA) at ECI Software Solutions and BMBI’s Expert for Website & Product Data Management Solutions, comments:

“As our industry continues to digitalise, most businesses selling construction products understand the need for evolution, whether modernising processes or implementing new systems.

“The same thinking must now be applied to their eCommerce offering. As a business grows, platform limitations become apparent, often demonstrating the need for a more advanced solution aligned with the merchant’s business model.

“Once the go-to eCommerce platforms for many businesses, Magento and Shopify are among a number of long-standing platforms of choice that are losing their applicability, as they do not offer the complex B2B functionality customers expect in our sector.

“This is because they were designed and built for retail businesses, but they struggle to meet the demands of the complex building materials supply environment.

“The significant investment of time, expertise, and resources to develop, test, maintain and administer complex eCommerce solutions has created significant hurdles for those trying to add online sales and services to their business proposition.

“Moreover, regular security patches and updates often create compatibility issues with third party extensions or custom-built code. System outages, bugs and support cases are frequent, frustrating and costly occurrences, alongside fears of security compromises. Beyond this, an eCommerce platform’s architecture may simply not be modern enough to meet the needs of today’s market.

‘Offline branch-based services online’

“Speaking with more digitally mature merchants and suppliers, it’s clear that businesses need a B2B platform that can project all their offline branch-based services online.

“This includes customer-specific pricing and catalogues, multi-level user accounts with varying levels of access and permissions, streamlined inventory management for click-and-collect orders, the ability to allocate purchases to cost centres and/or specific jobs to split baskets between delivery and collection, and much more.

“To meet these needs, a platform must first offer the functionality and then be integrated into the back-office trading systems.

“Switching from well-known eCommerce solutions may not be a simple prospect for merchants, but it’s an essential step in staying competitive in the digital omnichannel world. The more merchants embrace true B2B eCommerce, the more of the market they will capture.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: [email protected]

Visit Supplier's page

Latest news

26th July 2024

Enfield Speciality Doors completes world-class project for Atlas Copco HQ

A rundown office and warehouse building completely transformed into a modern headquarters for Atlas Copco has been fitted with more than 120 internal fire doors from Enfield Speciality Doors.

Posted in Access Control & Door Entry Systems, Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Doors, Interior Design & Construction, Interiors, Posts, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Sustainability & Energy Efficiency, Timber Buildings and Timber Products, Wooden products

26th July 2024

Abloy UK launches new white paper

Abloy UK, a leading provider of security and access control solutions, has launched a new white paper.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Information Technology, Innovations & New Products, Publications, Research & Materials Testing, Security and Fire Protection

26th July 2024

MCRMA Member Profile: David Roy, Director of Roofconsult

David Roy of MCRMA member company Roofconsult has more than 50 years’ experience to draw upon working in the building envelope sector and a unique perspective on how it has changed in that time.

Posted in Articles, BIM, Infrastructure & CAD Software, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Services, Building Systems, Cladding, Information Technology, Restoration & Refurbishment, Retrofit & Renovation, Roofs, Walls

26th July 2024

Strand: Enhancing Door Functionality and Safety

Craig Fox, Sales Director for Strand Hardware, outlines how door industry professionals might apply door limiting stays…

Posted in Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: