BMBI: Nominal uplift in Q4 2022 – inflation driving growth

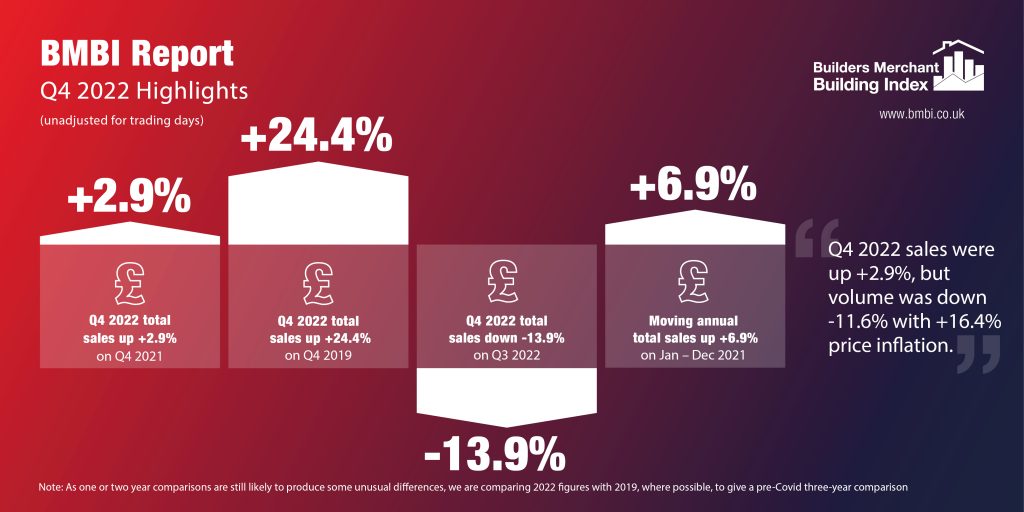

The BMBI‘s latest total value sales data from Britain’s Builders’ Merchants shows Q4 2022 recorded +2.9% year-on-year growth, with +16.4% price inflation compensating for volumes which fell -11.6%. With one less trading day this year, like-for-like value sales were +4.6% higher.

Quarterly sales, Year-on-Year

Ten of the 12 categories sold more in Q4 2022 compared to the previous year with Renewables & Water Saving again growing the most (+48.6%). Plumbing, Heating & Electrical (+18.6%) and Workwear & Safetywear (+14.8%) both recorded their highest quarterly revenues and were among the nine categories growing faster than Merchants overall. Only Landscaping (-5.9%) and Timber & Joinery Products (-11.5%) sold less.

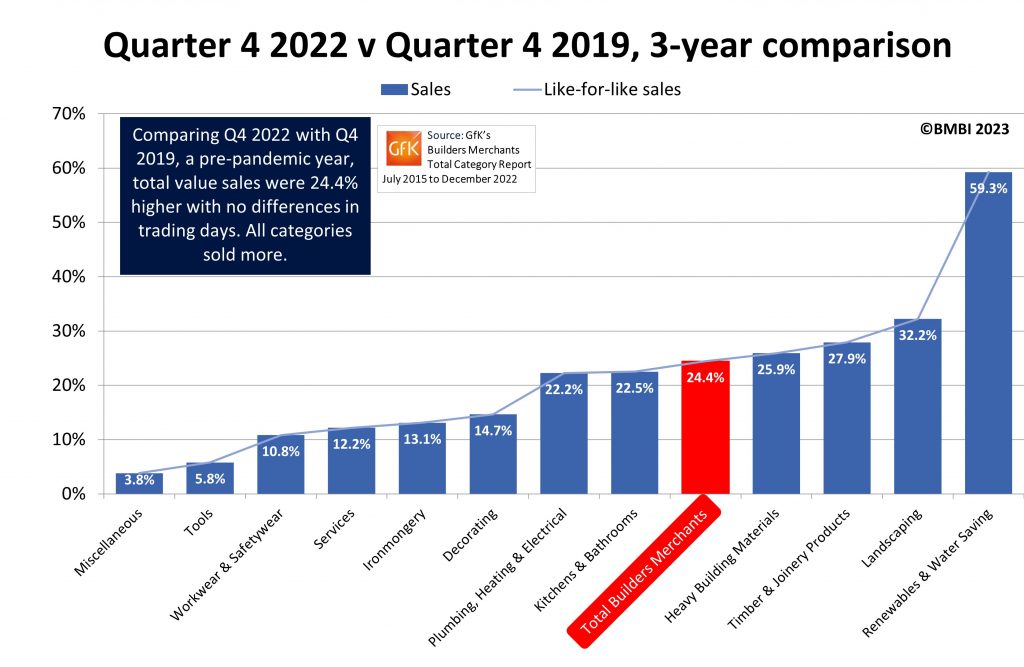

Comparing Q4 2022 with Q4 2019, a more normal pre-COVID trading year, sales for October to December 2022 were +24.4% higher than the same months three years ago. But, volume sales were -7.6% down and prices were up +34.7%. All categories sold more including significant increases for Renewables & Water Saving (+59.3%), Landscaping (+32.2%), Timber & Joinery Products (+27.9%), and Heavy Building Materials (+25.9%).

Quarter-on-quarter

Quarter-on-quarter, total value sales were -13.9% down in Q4 compared to Q3. Volume sales were -18.3% down while prices were up +5.4%. With five less trading days in the most recent period, overall like-for-like sales were -6.6% lower than Q3. Plumbing, Heating & Electrical (+13.2%) grew the most, followed by Workwear & Safetywear and Renewables & Water Saving (both +7.1%). Seasonal category Landscaping (-33.6%) was the weakest.

December sales, Year-on-Year

Lacklustre December sales didn’t help Q4, as total value sales dipped -1.7% compared to December 2021. Volume sales in December 2022 were down -17.9% and prices were up +19.7%. Taking trading days into account however, like-for-like sales were +4.5% higher in December 2022, with one less trading day. Nine of the twelve categories sold more with Renewables & Water Saving (+42.3%) the strongest performing category. Plumbing, Heating & Electrical (+19.1%), Decorating (+12.1%) and Kitchens & Bathrooms (+10.0%) also did better.

Total value sales in December 2022 were +24.4% higher than the same month three years ago. With one more trading day this year, like-for-like sales were +16.6% up. Volume sales were -10.9% lower and prices climbed +39.6%. All categories sold more, again led by Renewables & Water Saving (+60.5%).

December sales, Month-on-Month

Compared to the previous month, December 2022, total merchant sales were down -35.1% on November 2022. Volume sales were -38.3% lower and prices rose +5.3%. All categories sold less, in line with the seasonal trading patterns we expect in December.

Last 12 months

January to December 2022 sales were +6.9% higher than in the same 12 months a year earlier. Volume sales were -8.0% down while prices increased +16.2%. With three less trading days this year, like-for-like sales were up +8.2%. Ten of the twelve categories sold more. Renewables & Water Saving was the best performing category (+31.5%) while Kitchens & Bathrooms (+18.9%) and Plumbing, Heating & Electrical (+14.8%) also grew faster than Merchants overall. Landscaping (-0.6%), and Timber & Joinery Products (-2.2%) both sold less.

Gordon Parnell, Sales Director for British Gypsum, Saint-Gobain Interior Solutions, and BMBI’s Expert for Drylining Systems, says: “Despite some uncertainties, Q4 volumes were stable overall, albeit with some purchases driven by considerations of price inflation in January.

“Notably, the December PMI data showed the first decrease in employment since January 2021 and contractor purchases fell for the first time in three months due to lower workloads, marking its steepest rate in more than two and a half years.

“Construction output is also forecast to decrease by 4.7% in 2023, following two years of growth exceeding pre-pandemic levels. This is due to a multitude of factors, including the UK’s economic challenges, declining real household incomes and high interest rates.

“Therefore, the largest decrease in construction activity is likely to be in sectors heavily reliant on households, such as new build private housing and domestic RMI.”

‘A pressing issue’

“Despite the anticipated decrease in construction output, the shortage of skilled labour in the industry remains a pressing issue and must still be prioritised.

“The construction industry relies heavily on a skilled workforce to complete projects effectively and efficiently and failure to address this shortage could have a significant impact on its ability to recover from the current economic downturn and achieve sustainable growth in the future.

“To drive growth amid limited government activity and a subdued economic forecast, innovation is key, and we must provide valuable and efficient solutions to customers. Despite the difficulties we are facing, the market’s fundamental needs still offer reason for optimism. We are dedicated to serving customer needs and working across the supply chain to overcome obstacles.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: [email protected]

Visit Supplier's page

Latest news

26th July 2024

Enfield Speciality Doors completes world-class project for Atlas Copco HQ

A rundown office and warehouse building completely transformed into a modern headquarters for Atlas Copco has been fitted with more than 120 internal fire doors from Enfield Speciality Doors.

Posted in Access Control & Door Entry Systems, Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Doors, Interior Design & Construction, Interiors, Posts, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Sustainability & Energy Efficiency, Timber Buildings and Timber Products, Wooden products

26th July 2024

Abloy UK launches new white paper

Abloy UK, a leading provider of security and access control solutions, has launched a new white paper.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Information Technology, Innovations & New Products, Publications, Research & Materials Testing, Security and Fire Protection

26th July 2024

MCRMA Member Profile: David Roy, Director of Roofconsult

David Roy of MCRMA member company Roofconsult has more than 50 years’ experience to draw upon working in the building envelope sector and a unique perspective on how it has changed in that time.

Posted in Articles, BIM, Infrastructure & CAD Software, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Services, Building Systems, Cladding, Information Technology, Restoration & Refurbishment, Retrofit & Renovation, Roofs, Walls

26th July 2024

Strand: Enhancing Door Functionality and Safety

Craig Fox, Sales Director for Strand Hardware, outlines how door industry professionals might apply door limiting stays…

Posted in Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: