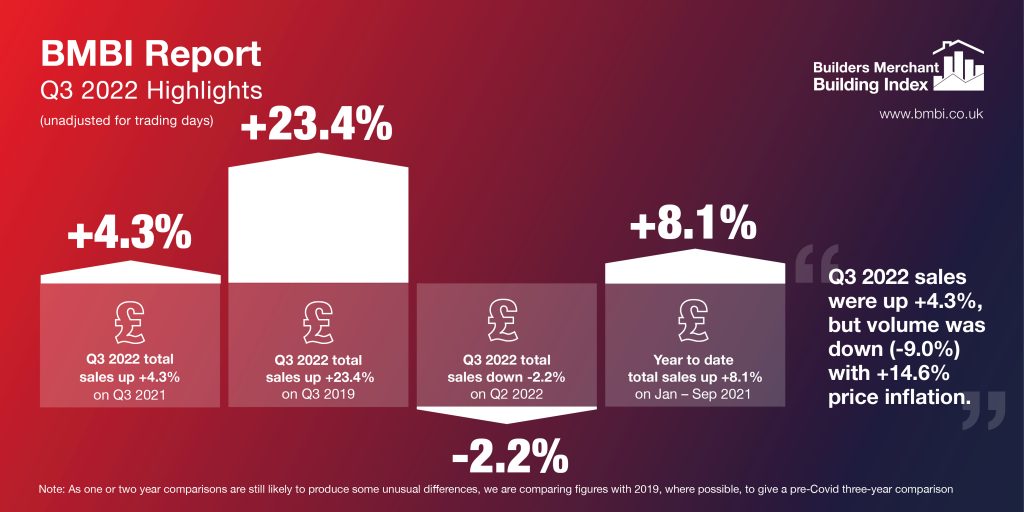

BMBI: Q3 2022 grows year-on-year, but inflation drives increase

The latest total value sales data from Britain’s Builders’ Merchants shows Q3 2022 recorded +4.3% year-on-year growth. However, price inflation (+14.6%) continues to drive the increase in sales, as volumes fall -9.0%. The BMBI has more…

Quarterly sales, Year-on-Year

Ten of the 12 categories sold more in Q3 2022 compared to the previous year with Renewables & Water Saving growing the most (+38.4%). Workwear & Safetywear (+23.6%), Kitchens & Bathrooms (+17.2%), and Plumbing, Heating & Electrical (+14.2%) all grew faster than Merchants overall. Heavy Building Materials also recorded strong growth (+11.9%) while Landscaping (-1.3%) and Timber & Joinery Products (-11.1%) were the only categories to sell less. With one less trading day this year, like-for-like sales were +5.9% up.

Comparing Q3 2022 with Q3 2019, a more normal pre-COVID trading year, total value sales were +23.4% higher this year. Volume sales were -6.8% down while prices were up +32.4%. Despite one less trading day in the most recent period, like-for-like sales were +25.3% higher. All categories sold more.

Quarter-on-quarter

Quarter-on-quarter, sales were down -2.2% in Q3 2022 compared to Q2 2022. Volume sales were down -5.5% and prices were up +3.5%. Despite four additional trading days in Q3, like-for-like sales were -8.3% lower. Renewables & Water Saving (+14.5%) was again the standout category, followed by Workwear & Safetywear (+8.1%) and Kitchens & Bathrooms (+6.2%). Seasonal category Landscaping (-18.3%) was weakest.

September sales, Year-on-Year

Q3 sales weren’t helped by a weak September, which was up just +3.0% year-on-year. Volume sales were down -9.6% and prices were up +13.9%. With trading days taken into account, like-for-like sales were +7.9% higher for September 2022. Nine of the twelve categories sold more including Renewables & Water Saving (+62.6%) and Workwear & Safetywear (+32.5%). Plumbing, Heating & Electrical (+13.1%), Kitchens & Bathrooms (+12.4%), Decorating (+11.3%) and Heavy Building Materials (+11.0%) grew more slowly.

Total value sales in September 2022 were +28.3% higher than the same month three years ago, with no difference in trading days. Eleven of the twelve categories sold more than September 2019.

September sales, Month-on-Month

Compared to the previous month, September 2022 total merchant sales were marginally down (-0.5%). Volume sales were flat (+0.1%) compared to August, and prices fell -0.6%. Half of the 12 categories sold more, again led by Renewables & Water Saving (+28.2%).

Last 12 months

Sales in the 12 months from October 2021 to September 2022 were +9.5% higher than in the same 12 months a year earlier, with two less trading days this year. All categories sold more. Renewables & Water Saving (+23.1%) was higher than other categories while Kitchens & Bathrooms (+17.9%) also did well. Landscaping (+2.9%) was weakest.

Clark McAllister, Sales Director Polypipe Civils & Green Urbanisation and BMBI’s Expert for Civils & Green Infrastructure, says: “Considering the somewhat turbulent quarter we’ve witnessed at the heart of government – and that’s putting it mildly – commercial activity across the civils and green urbanisation sectors has, by contrast, remained relatively steady over the last three months.

“The easing of building material availability continues, albeit at a relatively slow pace, and quotation volumes are holding firm. In certain markets, they are even slightly ahead of last year.

Possible optimism

“Grounds for optimism? With some analysts predicting an economic recession deeper and longer than we’ve seen for a generation, it would be a brave person to say so.

“The fact is, that for the short term at least, there is no consensus because the fundamentals keep changing. Not until the UK’s budget strategy is in place, and interest rates and inflation are given time to moderate will we able to determine forecasts with any degree of certainty.

“The inevitable consequence of this is that project starts are being pushed back. We see this to a lesser extent in publicly funded infrastructure programmes, as witnessed by the relatively stable civils numbers.

“It is across residential markets where we see delays having potentially the greatest impact. The early signs are there, but again it won’t be until we’re able to absorb the implications of the Chancellor’s Autumn Statement that we will have an indication of future trends.

“Climate change is never far from the headlines, and with COP27 behind us, we are seeing again how communities around the world, and not just those under immediate threat, look to the strategies and actions agreed at the conference for assurance that there is a unified approach to tackling the issue.

“From our own experience in the UK, we understand that change on the scale needed isn’t easy, but the momentum is driving investment and legislative commitment is growing. Let’s hope we see positive action and commitment following COP27.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: [email protected]

Visit Supplier's page

Latest news

26th July 2024

Enfield Speciality Doors completes world-class project for Atlas Copco HQ

A rundown office and warehouse building completely transformed into a modern headquarters for Atlas Copco has been fitted with more than 120 internal fire doors from Enfield Speciality Doors.

Posted in Access Control & Door Entry Systems, Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Doors, Interior Design & Construction, Interiors, Posts, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Sustainability & Energy Efficiency, Timber Buildings and Timber Products, Wooden products

26th July 2024

Abloy UK launches new white paper

Abloy UK, a leading provider of security and access control solutions, has launched a new white paper.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Information Technology, Innovations & New Products, Publications, Research & Materials Testing, Security and Fire Protection

26th July 2024

MCRMA Member Profile: David Roy, Director of Roofconsult

David Roy of MCRMA member company Roofconsult has more than 50 years’ experience to draw upon working in the building envelope sector and a unique perspective on how it has changed in that time.

Posted in Articles, BIM, Infrastructure & CAD Software, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Services, Building Systems, Cladding, Information Technology, Restoration & Refurbishment, Retrofit & Renovation, Roofs, Walls

26th July 2024

Strand: Enhancing Door Functionality and Safety

Craig Fox, Sales Director for Strand Hardware, outlines how door industry professionals might apply door limiting stays…

Posted in Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: