BMBI: Q3 volume sales down -10.5% on Q2 2022. Value sales down -3.3%

The latest total volume sales figures from Britain’s Builders’ Merchants from BMBI show that Q3 2023 volumes fell -10.5% in comparison to the same period in 2022. Total value sales were down -3.3% with prices rising +8.0%. There was no difference in trading days.

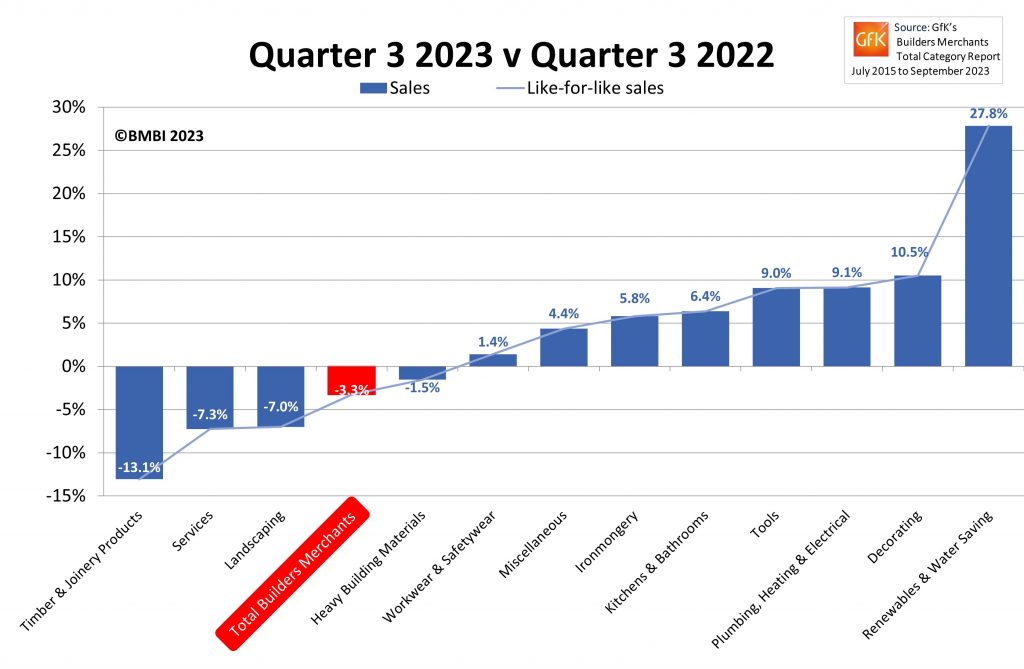

Year-on-year, of the twelve categories, eight sold more with Renewables & Water Saving (+27.8%) once again significantly ahead of the rest. The three largest categories all sold less in Q3: Heavy Building Materials (-1.5%), Landscaping (-7.0%) and Timber & Joinery Products (-13.1%).

Quarter-on-quarter

Total value sales dipped -1.4% in Q3 2023 in comparison with April to June 2023. Volume sales dropped -2.1% and prices edged up +0.8%. With four more trading days in the most recent period, like-for-like sales were -7.5% lower in July to September compared to Q2.

September sales, Year-on-Year

Q3 results weren’t helped by September total value sales, which were -6.1% down on the same month in 2022, with no difference in trading days. Volume sales fell -13.0% while prices rose +7.8%. Value sales of the largest three categories, Heavy Building Materials (-5.8%), Landscaping (-6.7%), and Timber & Joinery Products (-13.9%), were significantly down, although some smaller categories, Tools (+7.4%), Decorating (+7.3%), Kitchens & Bathrooms (+5.9%), Plumbing, Heating & Electrical (+3.3%) and Ironmongery (+1.7%), sold more.

September sales, Month-on-Month

Compared to August, September total merchant sales were down -3.4%. Volume (-2.7%) and prices (-0.7%) were also down. With one less trading day in September, like-for-like sales were +1.2% higher. Only three categories sold more: Workwear & Safetywear (+2.7%), Plumbing, Heating & Electrical (+2.3%) and Kitchens & Bathrooms (+0.8%). Seasonal category Landscaping (-9.2%) contracted the most.

Last 12 months

October 2022 to September 2023 value sales were down -1.9% on the same 12-month period in 2022, with no difference in trading days. Volume sales plunged -13.0% with prices increasing +12.8%.

Ian Doherty, Chief Executive of Hexstone, and the Owlett-Jaton brand, and BMBI’s Expert for Fasteners & Fixings, says: “As expected, the volume downturn seen in the second quarter has continued as the construction and RM&I sectors continue to be sluggish.

Ian Doherty, Chief Executive of Hexstone, and the Owlett-Jaton brand, and BMBI’s Expert for Fasteners & Fixings, says: “As expected, the volume downturn seen in the second quarter has continued as the construction and RM&I sectors continue to be sluggish.

“Reduced manufacturing costs in the Far East, together with lower shipping costs, have provided the drivers for cost price reductions, though these have been somewhat offset by the weakness of sterling against the US dollar in which both shipping and Far East costs are paid. Overall, this has led to some price deflation, which, together with the volume decline, has led to noticeably lower sales values.

Russian steel

“Following on from the EU’s decision to tighten sanctions against the use of Russian steel, the UK has now also introduced a similar regime requiring importers to prove that the products they are importing do not contain any Russian steel, even if they were manufactured in another country. These new sanctions took effect from 30th September 2023 and were introduced with relatively short notice.

“However, the UK has adopted more of a due diligence approach to the proof required, and HMRC, who are responsible for the enforcement of the sanctions, seem willing to accept a wider range of evidence that appropriate steps have been taken to ensure Russian steel is not being used. At the time of writing, we are now a couple of weeks into this new regime, it seems to have gone in with little or no disruption to supplies.

“It also seems that the EU’s stance on the required evidence is becoming more flexible, with individual customs authorities being given a degree of latitude on acceptable evidence. With Northern Ireland covered by the EU rather than the UK sanctions regime, this change has simplified movements to Northern Ireland and all indications are, that providing importers have undertaken appropriate due diligence, there should not be any supply difficulties caused by sanctions.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: [email protected]

Visit Supplier's page

Latest news

26th July 2024

Enfield Speciality Doors completes world-class project for Atlas Copco HQ

A rundown office and warehouse building completely transformed into a modern headquarters for Atlas Copco has been fitted with more than 120 internal fire doors from Enfield Speciality Doors.

Posted in Access Control & Door Entry Systems, Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Doors, Interior Design & Construction, Interiors, Posts, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Sustainability & Energy Efficiency, Timber Buildings and Timber Products, Wooden products

26th July 2024

Abloy UK launches new white paper

Abloy UK, a leading provider of security and access control solutions, has launched a new white paper.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Information Technology, Innovations & New Products, Publications, Research & Materials Testing, Security and Fire Protection

26th July 2024

MCRMA Member Profile: David Roy, Director of Roofconsult

David Roy of MCRMA member company Roofconsult has more than 50 years’ experience to draw upon working in the building envelope sector and a unique perspective on how it has changed in that time.

Posted in Articles, BIM, Infrastructure & CAD Software, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Services, Building Systems, Cladding, Information Technology, Restoration & Refurbishment, Retrofit & Renovation, Roofs, Walls

26th July 2024

Strand: Enhancing Door Functionality and Safety

Craig Fox, Sales Director for Strand Hardware, outlines how door industry professionals might apply door limiting stays…

Posted in Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: