BMBI: Record June delivers record breaking sales for merchants in Q2

Record breaking value sales in June helped Britain’s Builders’ Merchants hit their best ever quarter since the Builders Merchants Building Index (BMBI) began in July 2014.

Quarterly sales, Year-on-Year

The latest Q2 2021 report, published in August, confirms Total Builders Merchants value sales to builders and contractors were 96.0% higher than in Q2 2020, with no difference in trading days. Tools (+151.4%) had the highest year-on-year increase, with Kitchens & Bathrooms (+141.3%) also reporting strong growth. Four categories had their best-ever quarterly sales, including Heavy Building Materials (+81.4%).

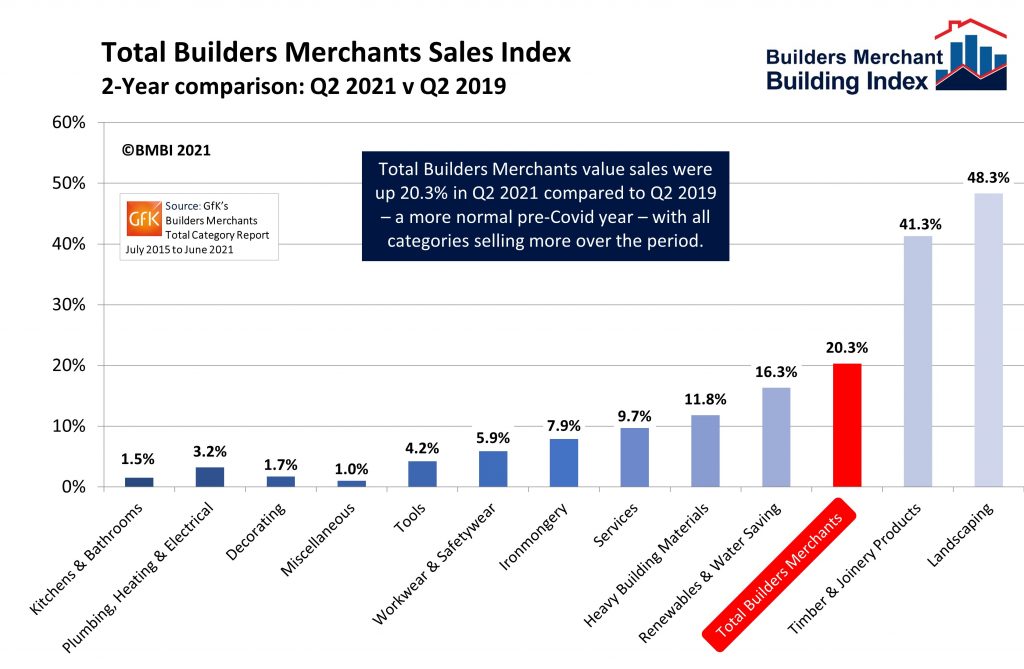

Total sales were also up compared to Q2 2019 (+20.3%) – a more normal pre-Covid year – with Landscaping and Timber & Joinery Products leading the field. All categories sold more over the period.

Quarter-on-quarter

Q2 total value sales were up 24.1% on Q1 2021 with two less trading days. Ten out of the 12 product categories sold more. Only Plumbing, Heating & Electrical (-3.5%) and Workwear & Safetywear (-11.4%) sold less.

June sales, Year-on-Year

Total sales for June 2021 were 29.5% higher than the same month last year, with all categories selling more. Timber & Joinery Products recorded its highest ever BMBI monthly sales (+57.5%), despite continuing material shortages. Heavy Building Materials also chalked up its best-ever monthly sales (+22.7%).

June sales, Month-on-Month

Total sales for June 2021 were 11.1% higher than May, helped by three extra trading days. All categories sold more, with Workwear & Safetywear (+16.7%), Timber & Joinery Products (+15.2%) and Kitchens & Bathrooms (+12.2%) outperforming merchants generally.

Year-to-date

Year-to-date sales for 2021 are well up on January to June 2020 (+49.2%), with one less trading day this year. All categories sold more than last year, with Timber & Joinery Products (+74.0%), Tools (+59.7%) and Landscaping (+58.6%) the leading categories. The first six months of 2021 is also measuring up well against the same period in 2019 (+13.5%).

Index

The Q2 BMBI index was 149.7 with one less trading day. Landscaping (237.5) and Timber & Joinery (183.0) were the strongest performers. Renewables was the only category below 100 (77.2).

Stacey Temprell, Marketing Director at British Gypsum and BMBI’s Expert for Drylining Systems, comments: “Our main focus throughout the second quarter was tackling the ongoing materials shortage that is currently consuming the construction industry. Raw materials have been growingly scarce and it’s likely these challenges will continue over the coming months.

“This has had a profound impact on construction product availability and costs, causing order backlogs and driving cost increases.

“With high levels of activity across the construction industry and suppliers struggling to meet demand, manufacturers and construction partners are finding it difficult to maintain their usual services to building clients.

“British Gypsum has been no exception, and we have felt this strain across a number of our product ranges. For example, paper liner used in our Gyproc Plasterboard range has been in limited supply, and PIR insulation producers for one of our Gyproc Thermal Laminates are experiencing increasingly high prices for the raw materials required.

“The shortage of steel has also led to the depletion of buffer stock we typically keep in our supply chain, and steel supplies are likely to be difficult for some time. To help, we have introduced an allocation system to ensure fair distribution of materials among our valued partner construction customers and manage the volume of product requirements.

‘Mitigation strategy’

“We continue to work hard on our mitigation strategy to increase supply levels, which includes securing material surety from some of our suppliers.

“We hope that in quarter three these shortages will begin to stabilise, and materials will become more readily available across the industry.

“Until then, we will work closely with customers and supplier partners to obtain regular, accurate and transparent information throughout the supply chain to aid communication.

“Despite current project delays, we’re confident that the construction industry will continue to thrive and recover once stock begins to increase again.

“Throughout quarter three, we look forward to seeing growth in the construction sector despite the substantial challenges of the past year, and look forward to the positive legacy we will create by building great spaces to work, rest and play.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

t: 01453 521 621

e: [email protected]

Visit Supplier's page

Latest news

26th July 2024

Enfield Speciality Doors completes world-class project for Atlas Copco HQ

A rundown office and warehouse building completely transformed into a modern headquarters for Atlas Copco has been fitted with more than 120 internal fire doors from Enfield Speciality Doors.

Posted in Access Control & Door Entry Systems, Articles, Building Industry News, Building Products & Structures, Building Systems, Case Studies, Doors, Interior Design & Construction, Interiors, Posts, Restoration & Refurbishment, Retrofit & Renovation, Security and Fire Protection, Sustainability & Energy Efficiency, Timber Buildings and Timber Products, Wooden products

26th July 2024

Abloy UK launches new white paper

Abloy UK, a leading provider of security and access control solutions, has launched a new white paper.

Posted in Access Control & Door Entry Systems, Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Information Technology, Innovations & New Products, Publications, Research & Materials Testing, Security and Fire Protection

26th July 2024

MCRMA Member Profile: David Roy, Director of Roofconsult

David Roy of MCRMA member company Roofconsult has more than 50 years’ experience to draw upon working in the building envelope sector and a unique perspective on how it has changed in that time.

Posted in Articles, BIM, Infrastructure & CAD Software, Building Associations & Institutes, Building Industry News, Building Products & Structures, Building Services, Building Systems, Cladding, Information Technology, Restoration & Refurbishment, Retrofit & Renovation, Roofs, Walls

26th July 2024

Strand: Enhancing Door Functionality and Safety

Craig Fox, Sales Director for Strand Hardware, outlines how door industry professionals might apply door limiting stays…

Posted in Architectural Ironmongery, Articles, Building Industry News, Building Products & Structures, Building Services, Doors, Facility Management & Building Services, Health & Safety, Restoration & Refurbishment, Retrofit & Renovation

Sign up:

Sign up: